Professional Tax Slabs & Rates FY 2020-21

Updated on : 2020-Dec-04 17:16:03 | Author :

Professional Tax Slabs & Rates FY 2020-21

Professional tax (PT) is levied by the varied State Governments of india on salaried people, working in government or non-government entities, or in practice of any profession, including chartered Accountants, Doctors, Lawyers etc or perform some kind of business. this manner of tax is in practice for a long time and States were presented the ability of leveling the Tax under Clause (2) of Article 276. The professional tax slabs & rate is fixed supported the income slab of an individual. the utmost quantity of pt which will be levied by any State during a fiscal year is Rs 2500/-.

Professional Tax Enrolment and Registration:

The total quantity of professional tax paid throughout the year is allowed as Deduction under the income tax Act. However, people filing income tax return below the New tax system would got to precede deductions offered on such payments.

Income Tax for Financial Year 2020-21

The professional tax is a source of revenue for the State Governments serving to them in implementing varied schemes for the welfare & development of the region. Recommendations are created to revise the higher limit professional Tax Rates as last revision was created in 1988. professional Tax Rates for The financial year 2020-21 for the individual States has been mentioned in this post.

Previous Year Professional Tax Rates 2019-20

Professional Tax is subtracted by the employers for the salaried staff and same is deposited with the state government. For others, they need to directly pay it to the govt or through the native Bodies appointed to do therefore. The tax must be collected and deposited as per the timeline provided by the various state governments. In case, one fails to do therefore, penalty and late fee is applicable as per the Act.

The Tax could also be paid to the govt on Monthly, Semi Annually or Annually basis depending on nature of business and therefore the various State Laws. Professional tax return has to be filed at the end of the financial year. For the financial year 2020-21, few states have created minor alteration that has been updated in this post. just in case of any clarification, please get up-to-date with the commercial Tax Department of the respective State.

State-wise Professional Tax Slabs and Rates for Financial Year 2020-21

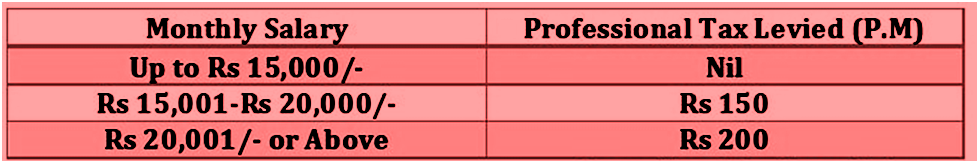

Andhra Pradesh Professional Tax

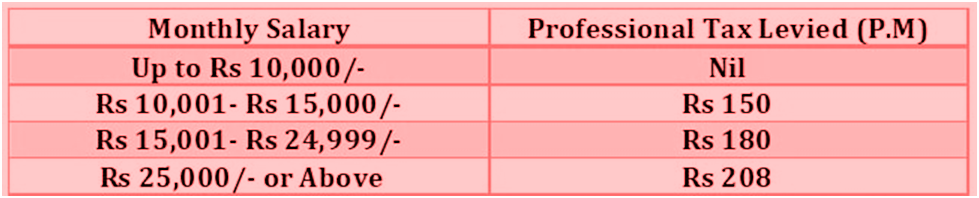

Assam Professional Tax

Bihar Professional Tax

Goa Professional Tax

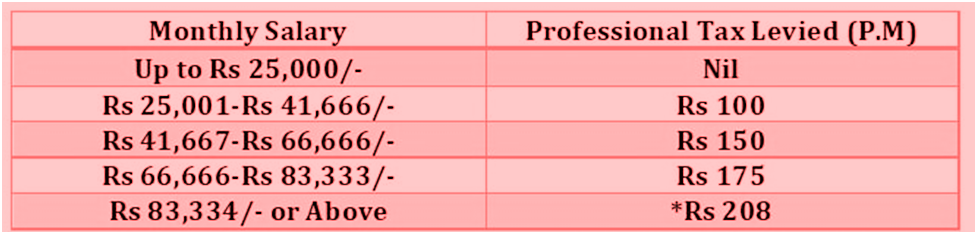

Gujarat Professional Tax

Jharkhand Professional Tax

*Professional Tax is payable at the rate Rs 208 for first 11 months and Rs 212 in the last month.

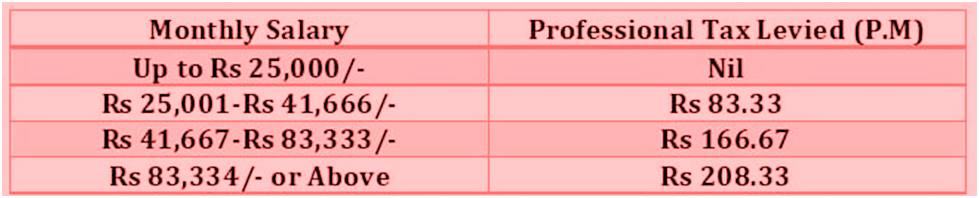

Karnataka Professional Tax

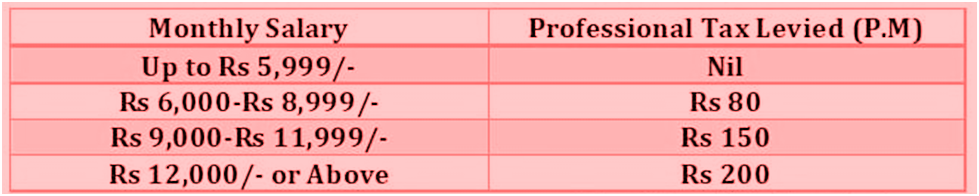

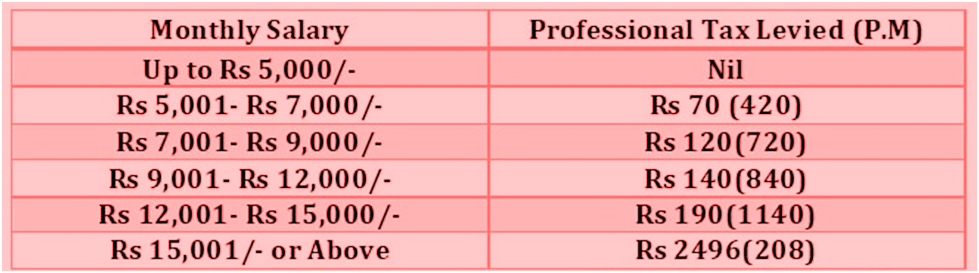

Kerala Professional Tax

Collected every six months. In ()bracket Professional Tax payable Semi Annually is mentioned.

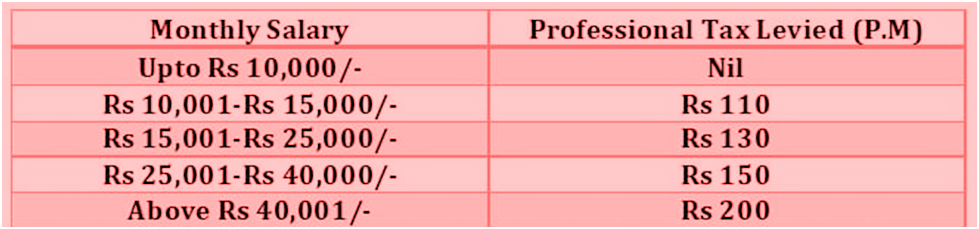

Madhya Pradesh Professional Tax

* Madhya Pradesh levies Professional Tax at the rate Rs 208 for 11 months and Rs 212 for the last 212 for the last month.

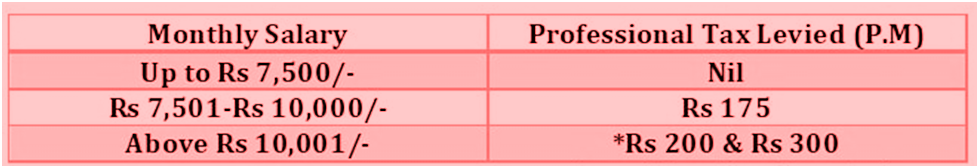

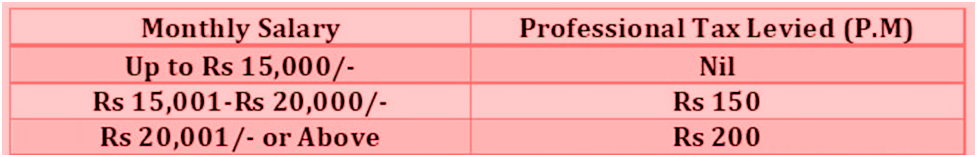

Maharashtra Professional Tax

*Maharashtra Government levies Professional Tax at the rate Rs 200 for 11 months and Rs 300 for the last month.

**Women earning Salary up to Rs 10,000/- per month are exempted from paying Professional Tax.

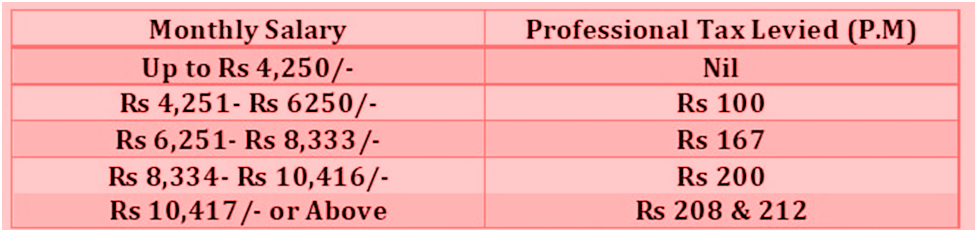

Manipur Professional Tax

*Manipur levies Professional Tax at the rate Rs 208 for 11 months and Rs 212 for the last month.

Meghalaya Professional Tax

*Professional Tax is payable at the rate Rs 208 for first 11 months and Rs 212 in the last month.

Nagaland Professional Tax

Odisha Professional Tax

*Professional Tax will be payable at the rate Rs 200 for first 11 months and Rs 300 in the last month.

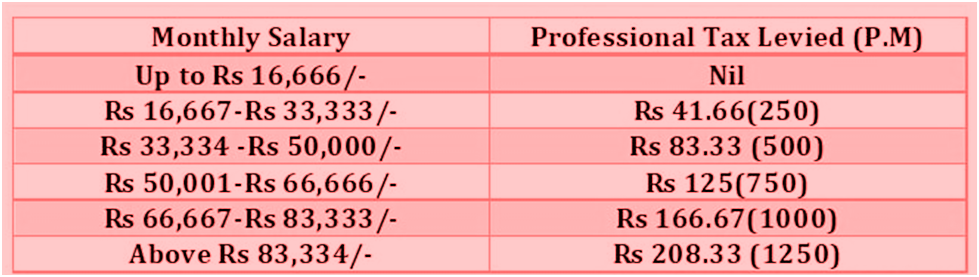

Puducherry Professional Tax

Collected every six months. Amount given in ()bracket is the Professional Tax payable Semi Annually.

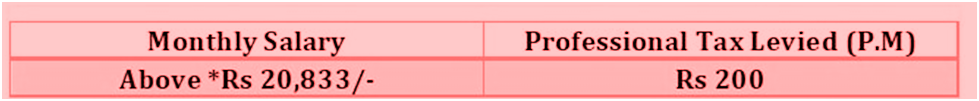

Punjab Professional Tax ( State Development Tax)

*Taxable Income

Sikkim Professional Tax

Tamil Nadu Professional Tax

Collected every six months. In ()bracket Proffessional Tax payable Semi Annually is mentioned.

Telangana Professional Tax

Tripura Professional Tax

Collected every six months. Amount given in bracket is the Professional Tax payable Semi Annually.

West Bengal Professional Tax

States and Union Territories : Professional Tax Slabs & Rates is Not Applicable

Some of the States don't levy or are however to levy professional Tax like Rajasthan, Arunachal Pradesh, Haryana, Uttar Pradesh, Uttaranchal and few additional more seven Union Territories. Currently, twenty states and one Union Territory levy professional Tax.

Exemption from Paying Professional Tax (As per the Act)

#Any person suffering from a permanent physical disability (including blindness) betting on provisions of pt of the various State.

#Parents or guardian of anyone who is suffering from backwardness, if the pt Act provides provision for the same.

#Persons who have completed the age of sixty five years. Subject to exemption provided by various State. (60 years just in case of Karnataka)

#Parents or guardians of a baby suffering from a physical disability as per clause (C) w.e.f 1.10.1996, applicable as per State provisions.

Additional Resources: