Why choose Lenstax for LLP REGISTRATION ?

- Free Tax Consultant

- GST Number

- Return Filing with Nominal fees

- 24x7 Support

- Experienced Resources

- Dedicated Account Manager

LLP REGISTRATION IN INDIA:

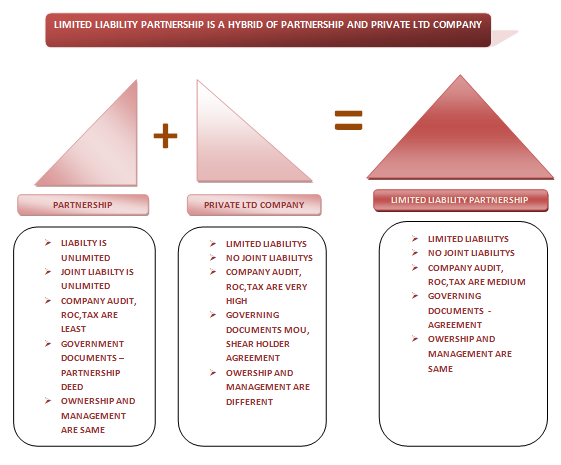

If two or more people want to get engaged in the same business, then there are three options, namely Private Limited Company, Partnership, and LLP. Let us have a brief discussion on LLP.

What is LLP?

LLP is a partnership in which some or all partners (depending on the jurisdiction) have limited liabilities.

Features of LLP:

- The LLP is a separate legal entity.

- Minimum 2 Partners are required to form an LLP. Maximum partners have no Limit.

- No minimum capital is required to start an LLP.

Advantages to choose LLP:

- Each partner has to enjoy Limited liability.

- No partner is liable for the activities of other partners.

- LLP has a Separate Legal Entity. Can Sue and can be Sued

- Less Statutory formalities than Companies.

Documents required for LLP registration in India:

-

PAN Card or Passport for Foreigners.

-

Drivers license or Aadhar card, residence card or election identity card or any other identity proof issued by the Government.

-

Less than 3 months old bank statement or telephone bill.

-

The authorization from the Landlord.

-

Any Proof of evidence utility service like electricity, telephone, gas, etc. Delimitate the address of the foretaste in the name of the owner or document, it is very important to remember which is not older than two months.

Get it @ ₹ 6999 only