Email us at ask@lenstax.com

We strive to provide Our Customers with Top Notch Support to make their Service Experience Wonderful GET ADVICEBOOKKEEPING

It is a process where collecting and sorting the source documents formally. Book-keeping is the systematic recording and organizing of financial transactions in a company.

It is a process of record regarding a financial transaction on a day-to-day basis. It helps your business to monitor your financial transactions and financial information related to your business.

This process ensures that records of the individual financial transactions are every time correct, up-to-date, and comprehensive. You can maintain your Accuracy through this process.

The bookkeeping method is performing by the machine (software and excel) this day. But in some places, the bookkeeping method performs by the bookkeeper.

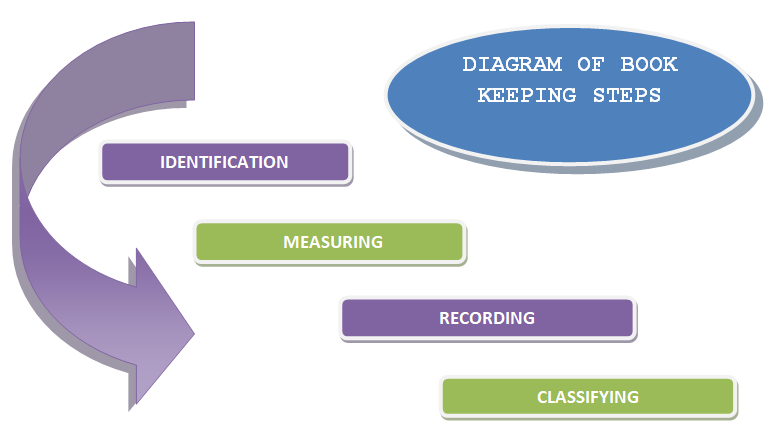

Steps of bookkeeping

Identification – This is the first step of the bookkeeping method. Here we have collected all the purchase and sale bills, invoice bills, cheque payments, all types of transactions.

Measuring – In this step, we separate (prepare ledger) all the purchase and sale bills, invoice bills, cheque payments, all types of transactions.

Recording - This is the first step of the bookkeeping method. Here we have collected all the purchase and sale bills, invoice bills, cheque payments, all types of transactions.

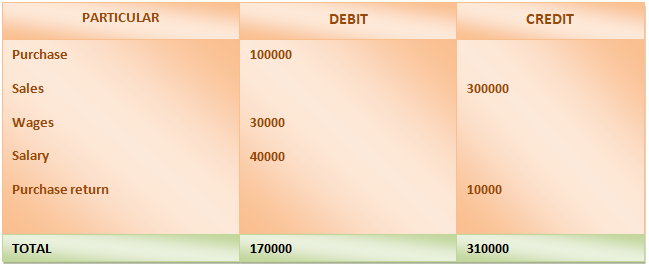

WHAT IS A GENERAL JOURNAL

It is the book, where records all the purchase and sale bills, invoice bills, cheque payments, all types of transactions daily.

Kept data into a ledger or account posting sale and purchase basis or posting inward and outward basis.

Make this at the end of the period of the month or week.

ACCOUNTING

Accounting is the process of recording financial transactions pertaining to a business. The accounting process includes summarizing, analyzing, and reporting these transactions to oversight agencies, regulators, and tax collection entities. The financial statements used in accounting are a concise summary of financial transactions over an accounting period, summarizing a company's operations, financial position, and cash flows.

BILLING

An act or instance of preparing or sending out a bill or invoice. The total amount of the cost of goods or services billed to a customer, usually covering purchases made or services rendered within a specified period.

Billing is mainly used in inward and outward control.

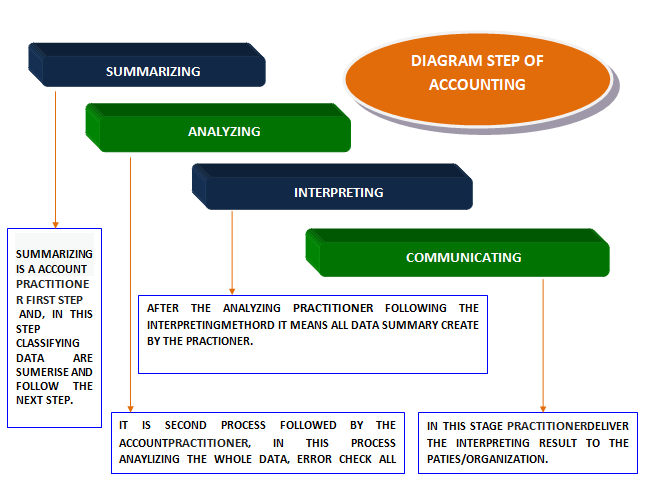

Step of Accounting

Basically summarizing, analyzing, interpreting, communicating the four steps are followed by the accounting practitioner.

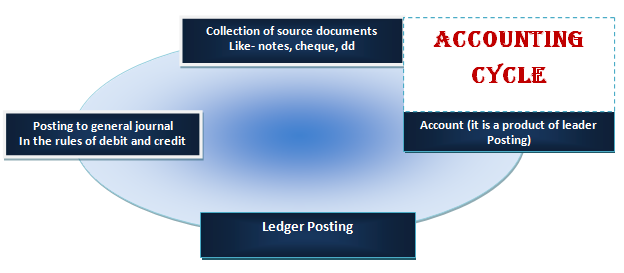

Accounting cycle

Who use the Accounting Data

EXTERNAL USE

- Investor

- Creditors

- Customers

- Suppliers

- Tax authorities

- Regulatory authorities

INTERNAL USE

- Management

- Employee

Classification of billing

Billing classifications are used to group similar free text invoices for processing and viewing. Billing classifications include the following information:

Billing classification code (up to 15 alphanumeric characters)

Description (up to 60 characters)

Terms of payment

Interest information

Number sequence for invoice number

Number sequence for credit notes

Number sequence for collection letters

Billing codes that can be assigned to invoices that use this billing classification

Billing codes

Billing codes provide a set of default billing values and rates for a defined type of service or charge. Billing codes include the following information:

Billing code (up to 10 alphanumeric characters)

Description (up to 60 characters; this will print on the invoice)

Effective date and expiration date

Sales tax information

Interest information

Accounting distribution

Rate information

Project information

Custom fields

VOUCHER

It is often a renumbered from used in the accounts payable department to standardize and enhance a company internal control over payments to it voucher and service providers. A voucher is usually prepared after a vendor invoice has been matched with the company purchase order and receiving report.

Supporting Document for Voucher

- All transaction records

- Invoice bill

- Equation

- Purchase order

- Revaluation

- Good receive document

Key Points of Voucher

After the supporting document receive you prepare then manual voucher

After the annual voucher you should create acomputerized vouches as like manual voucher.

At last you attach all supporting documents in your manual voucher.

Invoice no and date is the most important to create voucher.

Assistant account and account manager sing is very important for the voucher.

Type of voucher

It is basic two types – Accounting voucher,inventory voucher. Let discuss more

ACCOUNTING VOUCHER

- Contra voucher

- Payment voucher

- Receipt voucher

- Journal voucher

- Journal voucher

- Sales return voucher

- Debit note voucher

- Reversing journal voucher

- Memorandum voucher

INVENTORY VOUCHER

- Purchase order voucher

- Sales order voucher

- Rejection inward voucher

- Rejection outward voucher

- Stock journal voucher

- Delivery note voucher

- Receipt note voucher

- Physical stock voucher

We provide best services for you.

Competently recaptiualize multifunctional schemas without an expanded array of niches. Continually engage cooperative sources vis-a-vis web-enabled benefits.

QUALITY WITH CONSISTANCY

We work with honesty and try to give you best

QUICK PROCESS

We don't have time to compromise so we process every things quickly

LOWEST COST

The major sbenefit cloud hosting offers resources of multiple servers.

30+ PROFESSIONALS

The major benefit cloud hosting offers resources of multiple servers.

FREE ADVICE FOR START UP

The major benefit cloud hosting offers resources of multiple servers.

Money Back Guarantee

The major benefit cloud hosting offers resources of multiple servers.