Payroll process

Updated on : 2020-Nov-20 16:34:56 | Author :

Payroll process

Pre-payroll activities

Defining payroll policy

The net quantity to be paid is affected by multiple factors. The company's numerous policies like pay policy leave and benefits policy, attendance policy, etc. come into play at that point. As a primary step, such policies have to be compelled to be outlined and get approved by the management to verify the traditional payroll method.

Gathering inputs

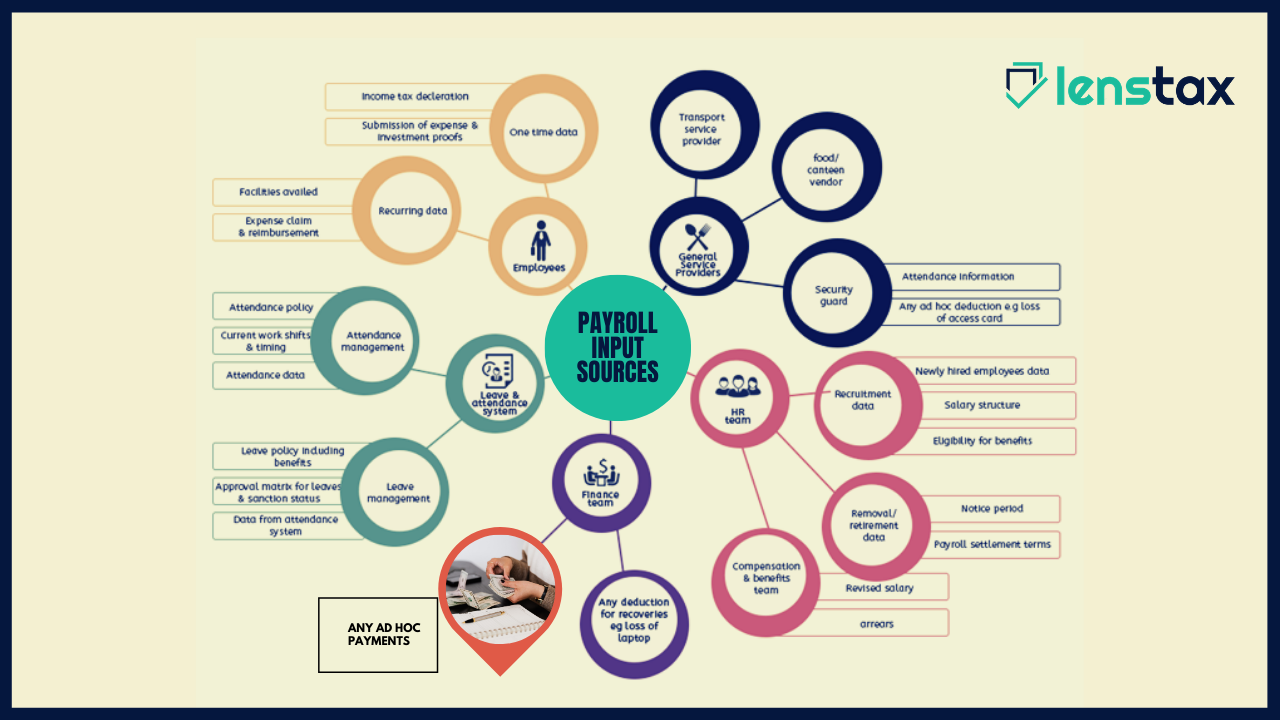

Payroll method involves interacting with multiple departments and personnel. There can be information like mid-year salary revision information, attendance information, etc.

In smaller organizations, these inputs are received from a consolidated source or fewer groups. However, in an exceedingly larger organization, the task of gathering information might look overwhelming. If you're employing a smart payroll software having integrated options like leave and attendance management, worker self-service portal, etc. inputs collection method doesn't remain a problem.

Input validation

Once inputs are received, you wish to check for validity of the info regarding adherence to company policy, authorization/approval matrix, right formats, etc. you also got to make sure that no active worker is ignored and that no inactive worker records are enclosed for salary payment.

Actual payroll process

Payroll calculation

At this stage, the valid input data is fed into the payroll system for the actual payroll process. The result is net pay when adjusting the necessary taxes and alternative deductions. Once the payroll method is over, it's always a decent practice to reconcile the values and verify for accuracy to avoid any errors.

Post-payroll process

Statutory compliance

All statutory deductions like EPF, TDS, and ESI are subtracted at the time of process payroll. The corporate then remits the quantity to the individual government agencies. The frequency will vary counting on the type of the dues. In most cases, payment of dues is created via challans. In spite of everything dues are paid return/report are filed. E.g., for filing PF return, ECR is generated and filed.

Payroll accounting

Every organization keeps a record of all its monetary transactions. Salary paid is one of the numerous operating costs that must be according in the books of accounts. As a part of payroll management, it's essential to check that every one salary and reimbursement information is fed accurately into accounting/ERP system.

Payout

You can pay a salary by cash, cheque or bank transfer. Usually, organizations provide employees with the salary bank account. Once you complete payroll, you wish to make sure that the company’s bank account has comfortable funds to create the salary payment. Then you wish to send a salary bank recommendation statement to the involved branch. This statement is issued with particulars like employee id, bank account number, the quantity of wages, etc. If you're choosing payroll software that has employee self-service portal, you can simply publish the payslips and employees can log-in to their account and access the payslips.

Reporting

Once you complete payroll runs for a selected month, finance and high management team might raise reports like department wise employee cost, location wise employee cost, etc. As a payroll officer, it becomes your responsibility to dig into the data and extract the required information and share the reports.

Additional Resources: