PAN QUERIES

Updated on : 2020-Nov-22 17:36:08 | Author :

PAN QUERIES : PAN Registration,Eligibility for PAN

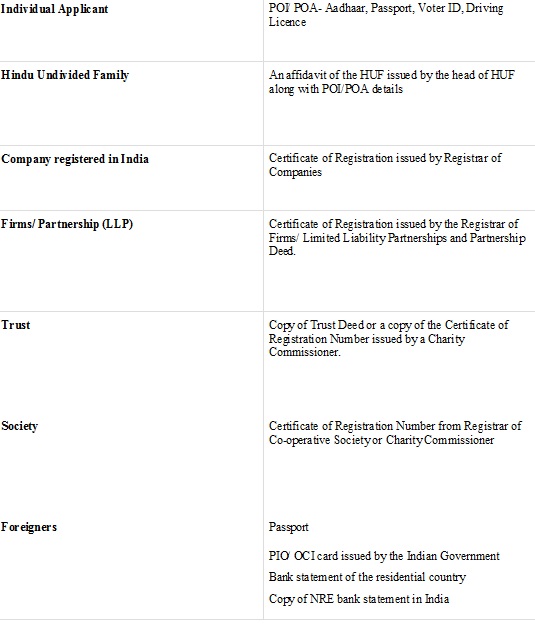

1.Document required for pan registration

PAN needs 2 forms of documents. Proof Of Identity (POI) and Proof Of Address (POA). Any 2 of the subsequent documents should meet the standards

2. How to edit PAN?

PAN is updated by the subsequent steps:

• Go to the NSDL web site and choose the update PAN section

• Select choice “Correction” in existing PAN data

3. Why do you need PAN?

PAN is a unique identification number that permits every tax paying entity of india with the following:

• Proof of Identity

• Proof of Address

• Mandatory for Filing Taxes

• Registration of Business

• Financial transactions

• Eligibility to open and transact Bank Accounts

• Phone connection

• Gas connection

• Mutual Fund – PAN is helpful to complete e-KYC for mutual fund investments.

The union budget 2019 has planned for taxpayers to use Aadhaar instead of PAN for filing taxation returns on or once one September 2019. it has been planned among the union budget 2019 that the Income-tax officer can themselves allot PAN to taxpayer filing associate with Aadhaar.

4. Eligibility for PAN

PAN Card is issued to people, companies, non-resident Indians, or anyone who pays taxes in india.

5. What are the benefit of having pan card?

1. For purchase or sale of vehicles except for two-wheelers.

2. For the application, related to the issuance of a credit card.

3. For Demat account opening which is done with any depository or with a custodian of securities or any person with Securities Exchange Board of India.

6. How much cost need for pan card registration?

The cost of PAN card is Rs. 110 or Rs. 1,020 (approximately) if PAN card is to be dispatched outside India

7. How to apply for PAN Card online?

A PAN Card is applied for in 2 ways. One will apply on-line for pan card through the favored on-line pan card application method or alternately, the offline mode of PAN card application may additionally be used. in the following sections we are going to discuss the ways you'll be able to use to apply for and get a PAN card.

Online PAN Card Application Process –

Here are the steps that are to be followed once applying for the PAN Card using the online mode of application and PAN card registration:

Step 1: Visit the relevant web site of NSDL or UTIITSL for on-line application for PAN Card.

Step 2: On the web site choose the choice ‘New PAN’ on the home page.

Step 3: there's a replacement PAN Card type 49A that ought to be elect for people whether or not they are Indian voters, NRE/NRI or OCI people.

Step 4: this manner should be filled with the individual’s details.

Step 5: The applicant would even be needed to pay the process fee on-line of through a requirement Draft once submitting the shape to initiate process of the form.

Step 6: the ultimate page that is generated once paying the fees and submitting the stuffed out PAN form 49A contains the 15-digit acknowledgement number.

Step 7: The acknowledgement type ought to be sent to the NSDL PAN workplace by courier at intervals fifteen days of on-line submission of form 49A together with the involved documents.

Step 8: once the acknowledgement form is couriered to the NSDL workplace, PAN no. verification is finished and therefore the Card is generated once the NSDL PAN verification. The physical PAN card is distributed to the customer’s address as mentioned within the type within a period of fifteen days.

Additional Resources

PAN- Provisions, Obtain, Operat model, and Track Application