Financial technology terms

Updated on : 2020-Dec-31 15:41:49 | Author :

FinTech refers to Financial Technology. Financial Technology is the application of new technological advancements to products and services in the industry of finance. It enhances or automates financial services and processes. It is engaged in the rapidly growing broad industries serving both the consumers and businesses. Its applications can be seen from mobile banking and insurances to cryptocurrency and investment applications.

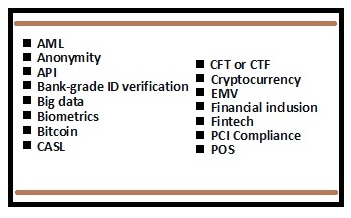

Terms related to the FinTech

There are a few important terms related to Financial Technology. They are as follows-

AML

To stop the practice of generating income through illegal actions a set of procedures, laws, or regulations is designed. Mostly money launderers hide their activities through some steps. These steps make it look like money coming from an illegal or unethical source.

Anonymity

Any kind of interaction of a user on the Internet protects his or her identity from being shared with other users or with a third party. There are different levels of anonymity that do exist. Examples of anonymity can be observed all over the Internet.

API

API refers to the Application Programming Interface. It is a set of requirements that governs how one can talk to the other.

Bank-grade ID verification

Bank-grade ID verification is a term used to describe identity verification. It meets the high standards of financial institutions for reliability, accuracy, and security.

Big data

Big data is an all-encompassing term. It is related to the collection of data sets so big and complex that it becomes very hard to process these using applications meant for traditional data processing.

Biometrics

Biometrics is the process of detection and record process. In this process, a person's unique physical and other traits are detected and then these are recorded. It is done by an electronic device or system to confirm the identity.

Bitcoin

Bitcoin is such a consensus network enabling a new payment process with completely digital money being the first decentralized method of p2p (peer to peer) payment network. It is powered by its users with no involvement of central authority or any middlemen. According to a user, the Bitcoin can be told as the cash for the Internet.

CASL

CASL refers to Canada’s Anti-Spam Legislation. It is the unofficial name of Canadian law. It is intended to help in protecting Canadians while ensuring that businesses can be continued to compete in the marketplace globally. It stops the sending of unsolicited commercial electronic messages sent by email or social media or text messages.

CFT or CTF

CFT= Combating the financing of terrorism

CTF= Counter-terrorist financing

These are policies put in place by many jurisdictions to prevent, trace, and recover illicitly-acquired assets. It proceeds crime, disrupts, and dismantles the global terrorist financial and criminal laundering operations. CFT or CTF is often associated with the AML while dealing with the issues of compliance.

Cryptocurrency

The cryptocurrency is a medium of exchange using the cryptographic method. It is used to secure the transactions and to control the creation of the new units.

EMV

EMV refers to Europay, MasterCard, and Visa. It is a global standard for the inter-operation of integrated circuit cards like IC cards or "chip cards" and IC card capable point of sale or POS terminals and automated teller machines or ATMs to authenticate the transactions done by credit and debit card.

Financial inclusion

The delivery of financial services at affordable costs to the sections of the disadvantaged and low-income segments of society is called Financial inclusion or inclusive financing.

Fintech

FinTech refers to the 'Financial Technology'. It has become a ubiquitous term for any kind of technology that has been applied to the financial services where technology is sold into the financial services sectors working for these customer’s back-office functions.

PCI Compliance

PCI Compliance refers to the payment card industry compliance. It is adherence to a set of some specific security standards which were developed for the protection of the card information during and after a successful financial transaction. It is required by all forms of card brands.

POS

POS refers to Point of sale. It is the capturing of data and customer payment information at a physical location while goods or services are bought by the buyer and sold by the seller. This kind of transaction is captured using devices like computers or cash registers or optical or bar code scanners or magnetic card readers or any combination of these devices.

To get more information about Financial technology click the following

- Financial service

- Uses and Applications of Financial services

- Block chain

- FinTech at a glance

- Functions of Financial services