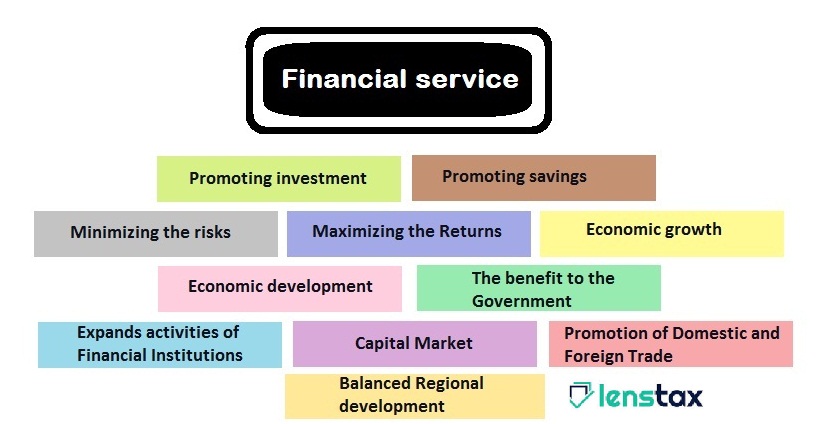

Functions of Financial services

Updated on : 2020-Dec-30 16:36:48 | Author :

The functions of Financial Services are-

Promoting investment

Financial services create more demand for products and the producer to meet the demand from the consumer goes for more investment. Then the financial services come to the rescue of the investor like the merchant banker through new issued marketing by enabling the producer to raise capital. The stock market helps to mobilize more funds by the investor. Investment from abroad is attractive. Both the domestic and foreign enable the producers not only to sell their products but also to acknowledge modern machinery or technology for further production later.

Promoting savings

Financial services like mutual funds provide ample opportunity for different types of savings. Different types of investment options are available for the convenience of the pensioners as well as the aged people so that they can be ensured of a reasonable return on the investment without a lot of risks. For interested people in the field of growth of their savings, various reinvestment opportunities are being provided. The laws implemented by the government regulate the working of various financial services in such a way that the interests of the public who saves through these financial institutions are provided high protection.

Minimizing the risks

Risk factors of both the financial services as well as producers are minimized by the presence of insurance companies. Different types of risks are covered here. It not only offers protection from the fluctuating business conditions but also the risks caused by natural calamities. Insurance is the source of both the finances and savings, besides minimizing the risk factors. Taking this aspect into the account, the government has privatized life insurance. It also set up a regulatory authority for the insurance companies known as IRDA (Insurance Regulatory and Development Authority), 1999.

Maximizing the Returns

Financial services enable businessmen to maximize their returns. This is possible because of the availability of credit at a reasonable rate. Producers can avail of different types of credit facilities to acquire the assets. In certain cases, they can even go for leasing of some certain assets which are of very high value. Factoring companies enable the seller and the producer to increase their turnover which also supports increasing the profit. Even under tough competition, the producers will be in a position to sell their products with a low margin. They can maximize their return with a higher turnover of stocks.

Ensures greater Yield

There is a difference between return and yield. Yield attracts more producers to enter the market and increase their production so that they can meet the demands of the consumer. The financial services enable the producer to both to earn more profits and maximize their wealth. Financial services enhance their goodwill so that they can induce those to go in for diversification. The stock market and the different types of derivative of markets provide many opportunities to get a higher yield for the investor.

Economic growth

The development of the sectors is essential to develop the economy. The financial services ensure equal distribution of the funds to all the three sectors named primary, secondary, and tertiary. Because of this, the activities are spread over in a balanced manner in all the three sectors. This brings in a balanced growth of the economy resulting in improved employment opportunities. The tertiary service sectors not only grow but also indicate that this growth is an important sign of the development of the economy. In a well-developed country, the service sector performs a major role in contributing more to the economy than in the other two sectors.

Economic development

Financial services enable consumers to obtain various kinds of products and services by which they can improve their living standards. Purchasing a car or house or other essentials and also the luxurious items is made possible through the hire purchase, leasing, and housing finance companies. Thus, the consumer is compelled to save while enjoying the benefits of the assets acquired with the help of financial services.

The benefit to the Government

Financial services enable the government to raise short-term and long-term funds to meet both revenue and capital expenditures. The government raises short term funds through the money market and by issuing the Treasury Bills. These are purchased by the commercial banks from out of their depositors’ money. Additionally, the government can raise long-term funds by sailing the government securities in the securities market that forms apart of the financial market. Even the government’s foreign exchange requirements can be met in the foreign exchange market. The most important benefit for the government is the raising of finance without offering any kind of security. In this way, financial services are a big boon to the government.

Expands activities of Financial Institutions

The financial services enable financial institutions to raise finance and get an opportunity to disburse their funds most profitably. Some of the services which get financed by financial institutions are mutual funds, factoring, credit cards, hire purchase finance are. The financial institutions expand their activities and thus diversify the usage of their funds for various kinds of activities ensuring economic dynamism.

Capital Market

One of the barometers of a country’s economy is the presence of a vibrant capital market. If there are hectic activities in the capital market, then it is an indication of the presence of any positive economic condition. The financial services ensure that all the companies become able to acquire adequate funds so that they can boost production and to gather more profits eventually. If there will be no financial services, there will be a paucity of funds affecting adversely the working of companies and will result in negative growth of the capital market. The more the capital market is active, the more the funds from foreign countries also flow in. Hence, we can say the changes in the capital market occur mainly due to the availability of financial services.

Promotion of Domestic and Foreign Trade

The financial services ensure the promotion of domestic and foreign trade. The factoring and for-failing companies promote the sale of goods in the domestic market and the export of goods in the foreign market. Banking and insurance services further help to step up these kinds of promotional activities.

Balanced Regional development

The government observes the growth of the economy and regions that remain economically backward are given fiscal and monetary benefits through taxation and cheaper credit promoting more investment. This helps to generate more production, demand, employment, income, and an increase in prices. The producers will earn more profits and will be able to expand their activities further. So, the financial services help backward regions in developing and catching up with the rest of the country that has been developed already.

Additional resources