What is Pay-slip?

Updated on : 2021-Jan-01 16:48:06 | Author :

What is Pay-slip?

A salary slip or pay slip is a document containing a detailed list concerning the assorted elements of your earnings in conjunction with specific details of employment. it's issued each month by an employer either within the form of a written hard copy or an electronic copy. Ideally a pay slip should contain an organization logo along with company name and address.

Table of Contents :

- Who gets a Salary Slip?

- Format of Salary Slip

- Salary Slip Sample

- What are the Components of a Salary Slip?

- Impact of Standard Deduction on Salary Slip

- Why is Salary Slip important?

Who gets a Salary Slip?

A salary slip is simply available to salaried workers and your employer is responsible for providing you a replica of your payslip monthly. Some smaller corporations may not often offer a salary slip and in such cases, you'll be able to ask your employer for a salary Certificate. Whereas most employers offer digital payslips, others would possibly offer physical copies of the same.

Format of Salary Slip

Different companies follow different formats of salary slips. This is a basic template for a salary slip includes the following:

- Company name, logo and address, Salary Slip month and year

- Employee Name, Employee Code, Designation, Department

- Employee PAN/Aadhaar, Bank Account Number

- EPF Account Number, UAN (Universal Account Number)

- Total Work Days, Effective Work Days, Number of Leaves

- Itemized list of Earnings and Deductions

- Gross Pay and Net Pay in numbers as well as words

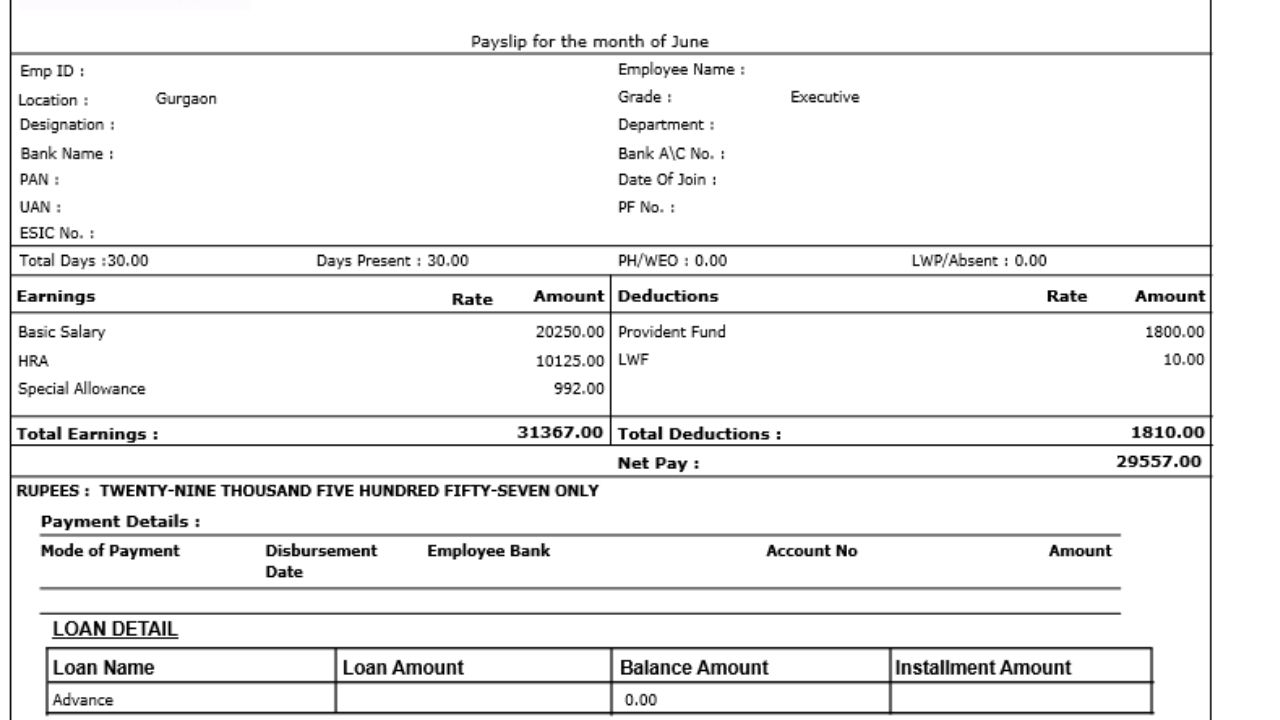

Salary Slip Sample

The following is a salary slip sample: (company name and address is not given)

The given format is just an example and your salary slip may include or exclude some of the components shown in the example above.

What are the Components of a Salary Slip?

1. Income/ Earnings

- Basic Salary: This comprises 35% to 40% of your salary, thus it is perhaps the most important component of salary.

- Dearness Allowance (DA): Calculated as a percentage of your basic pay, DA is given to offset the impact of inflation. This is completely taxable and need to be declared while ITR filing.

- House Rent Allowance (HRA): It is an allowance to help people pay their house rent. The amount of HRA depends on the situation and ranges between 40%-50% of basic pay. You’ll claim a part of the HRA as a tax deduction, provided you reside in a rented house as per Section ten of the income tax Act, 1961.

- Performance and Special Allowance: This is given to encourage employees for a better performance. This component is completely taxable.

- Other Allowances: This comprises the various additional allowances paid by an employer for any reason.

2. Deductions

- Employees Provident Fund (EPF): This comprises a compulsory deduction in your salary slip. This component of your salary slip is at least 12% of your basic salary and diverted to an EPF account.

- Professional Tax: This pay slip component is levied on all individuals, including the salaried, professionals and traders who have an income.

- Tax Deductible at Source (TDS): It refers to the amount of tax deducted by your employer on behalf of Income Tax department. You may also reduce TDS by investing in tax-saving schemes .

Impact of Standard Deduction on Salary Slip

Standard deduction was reintroduced within the Union Budget 2018-19 by the then FM Arun Jaitley. A add of Rs. 50,000 (increased from Rs. 40,000 within the Budget 2019-20) may be claimed as a typical deduction by the salaried workers, thereby reducing the tax outgo for salaried and pensioners. This has replaced the transport allowance and medical compensation parts within the pay slip.

Why is Salary Slip important?

-

- Income Tax Planning: You salary contains various components such as Basic, HRA, transport allowance, medical allowance, leave travel allowance, etc. that might have different tax treatments. Knowing the value of separate parts will form the basis for increasing your income tax savings for the applicable financial year.

- Proof of employment: This document serves as a legal proof of employment.

- To avail loans/ credit card: Your pay slip contains details of your monthly income which is a key factor that determines your ability to meet your debt obligations.

- For seeking further employment: Knowledge about the various components of your salary slip can help you assess other job offers.