What is Budgeting?

Updated on : 2021-Feb-08 13:11:42 | Author :

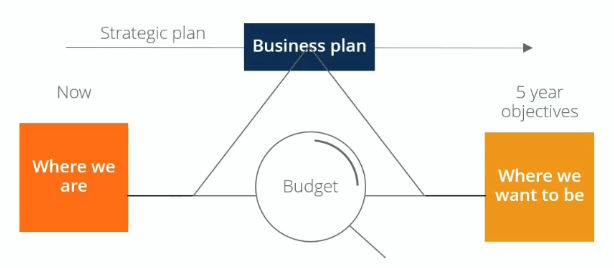

Budgeting is the military science implementation of a business plan. To achieve the goals in a business’s strategic plan, we need a close descriptive roadmap of the business plan that sets measures and indicators of performance. we can then make changes on the way to ensure that we have a tendency to arrive at the desired goals.

Translating Strategy into Targets and Budgets

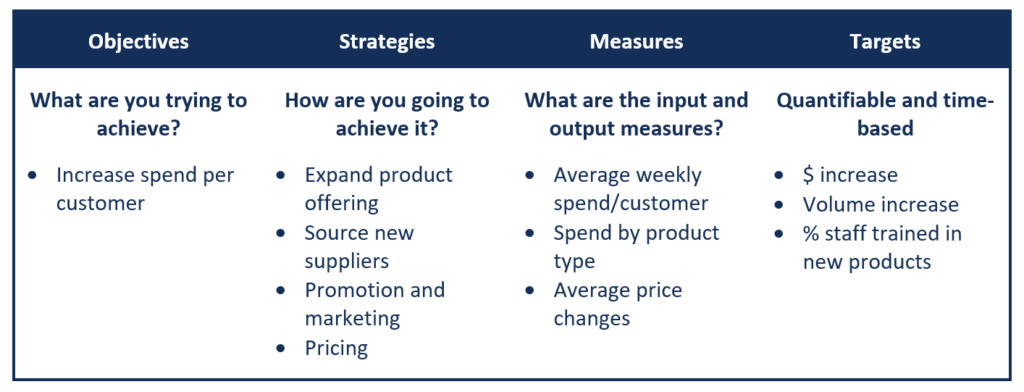

There are four dimensions to consider once translating high-level strategy, such as mission, vision, and goals, into budgets.

1. Objectives are basically your goals, e.g., increasing the amount each customer spends at your retail store.

2. Then, you develop one or more strategies to achieve your goals. The company can increase customer spending by expanding product offerings, sourcing new suppliers, promotion, etc.

3. You need to track and evaluate the effectiveness of the strategies, using relevant measures. For example, you can measure the average weekly spending per customer and average price changes as inputs.

4. Finally, you should set targets that you would like to reach by the end of a certain period. The targets should be quantifiable and time-based, such as an increase in the volume of sales or an increase in the number of products sold by a certain time.

Goals of the Budgeting Process

Budgeting is a crucial process for any business in several ways.

1. Aids in the planning of actual operations

The process gets managers to consider however conditions could change and what steps they need to take, while also permitting managers to understand how to address issues when they arise.

2. Coordinates the activities of the organization

Budgeting encourages managers to build relationships with the other parts of the operation and understand how the various departments and teams interact with each other and how they all support the overall organization.

3. Communicating plans to various managers

Communicating plans to managers is an important social aspect of the process, which ensures that everyone gets a clear understanding of how they support the organization. It encourages communication of individual goals, plans, and initiatives, which all roll up along to support the growth of the business. It also ensures appropriate people are made accountable for implementing the budget.

4. Motivates managers to strive to achieve the budget goals

Budgeting gets managers to focus on participation within the budget method. It provides a challenge or target for people and managers by linking their compensation and performance relative to the budget.

5. Control activities

Managers will compare actual spending with the budget to control financial activities.

6. Evaluate the performance of managers

Budgeting provides a method of informing managers of how well they are performing in meeting targets they have set.

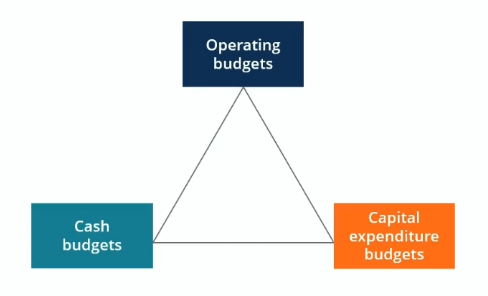

Types of Budgets

A robust budget framework is made around a master budget consisting of operating budgets, capital expenditure budgets, and cash budgets. The combined budgets generate a budgeted income statement, balance sheet, and cash flow statement.

1. Operating budget

Revenues and associated expenses in day-to-day operations are budgeted in detail and are divided into major categories such as revenues, salaries, benefits, and non-salary expenses.

2. Capital budget

Capital budgets are typically requests for purchases of large assets such as property, equipment, or IT systems that create major demands on an organization’s cash flow. The purposes of capital budgets are to allot funds, control risks in decision-making, and set priorities.

3. Cash budget

Cash budgets tie the other two budgets together and take into account the timing of payments and the timing of receipt of money from revenues. money budgets help management track and manage the company’s cash flow effectively by assessing whether extra capital is required, whether the company has to raise cash, or if there's excess capital.

The Process

The budgeting process for most large companies usually begins four to six months before the start of the financial year, while some may take an entire fiscal year to complete. Most organizations set budgets and undertake variance analysis on a monthly basis. starting from the initial planning stage, the corporate goes through a series of stages to finally implement the budget. Common processes include communication within executive management, establishing objectives and targets, developing an in-depth budget, compilation and revision of budget model, budget committee review, and approval.