Tax Planning for Salaried Employees for FY 2020-21

Updated on : 2021-Jan-03 17:16:59 | Author :

TAX PLANNING-F.Y.-20-21

AGENDA- OPTION I (OLD RATE)

- What is Tax Planning

- Tax Planning For Retirement Plans

- Calculation of Gross Total Income

- Tax Saving Deduction

- Allowance Available

- Calculation of Net Taxable Income

WHAT IS TAX PLANNING

-

The purpose of tax planning is to ensure tax efficiency.

-

Tax planning is an essential part of an individual investor’s financial plan.

-

Reduction of tax liability and maximizing the ability to contribute to retirement plans are crucial for success

-

Maximization of take home salary

-

For betterment of retirement

-

Increase of saving habit

TAX PLANNING FOR RETIREMENT PLANS

- According to the Indian laws, there are quite a lot of options provided to the taxpayers for deductions and concessions by which their tax liability would be

minimized. - From Section 80C to 80U, there are tax deductions available which are of great importance for taxpayers.

- As per the Income Tax Act, 1961 there are a number of sections like exemptions and tax credits which can be helpful in reducing your tax liabilities.

CALCULATION OF GROSS TAXABLE INCOME

-

Calculation of gross total income is essential for tax planning, because without that we cant find how much of amount we need to invest for saving tax and for investment for future.

-

There are various head under which we earn income on which tax is applicable at prevailing rate.

-

Gross Taxable Income= Income obtained from different Income Heads= Income from Salary + Income obtained from house property + Income obtained from profits and gains +Income from Long term capital gains and short term capital gains+ Income from other sources

WHERE TO INVEST TO SAVE TAXES?–

TAX SAVING DEDUCTIBLES- CONT….

Donation created to numerous establishment are allowable deduction Eg.- recently if anybody created donation to PM –Care Fund is 100 percent allowable deduction from gross total income.

ALLOWANCES AVAILABLE IN F.Y.-20-21

-

Standard Deduction- Rs. 50,000/- (For salaried Person)

-

House Rent Allowance

a) Total HRA received

b) Total amount of rent that is paid minus 10% of (Basic Salary + Daily Allowance)

c) 50% of the total salary for metro-cities and 40% for non-metro cities

-

Leave Travel Allowance

-

Section 80E

-

Repayment of Interest amount of loan taken for study (Education Loan)

-

80CCD

-

Investment of Rs. 50,000/- in NPS scheme over and above sec. 80

-

Section 80D

-

An individual can claim a deduction of up to INR 25, 000 for the premium paid for health insurance for self, spouse as well as children.

-

If you are a senior citizen then the deduction limit permissible is up to INR 50,000.

-

-

Section 80G

By this allowance, the bills of travel of an individual may be claimed for exemption against LTA. during a block of 4 years, you'll claim LTA twice. Moreover, it's possible to hold forward your unclaimed LTA to the next year moreover.

CALCULATION OF NET TAXABLE INCOME

The Income-tax is usually levied on the net cyber world wide taxable income and within the final step net taxable income is calculated.

Net taxable income= Total Gross Income – Tax Savings

After the calculation of net taxable income, your liabilities will be determined based on the Income-tax slab rates for FY 2020-21

AGENDA- OPTION II (NEW RATE)

- Tax Rates

- Condition for opting new option

- Deduction in Old Regime

- Compare Tax under Existing and New Regime

- Which option is better

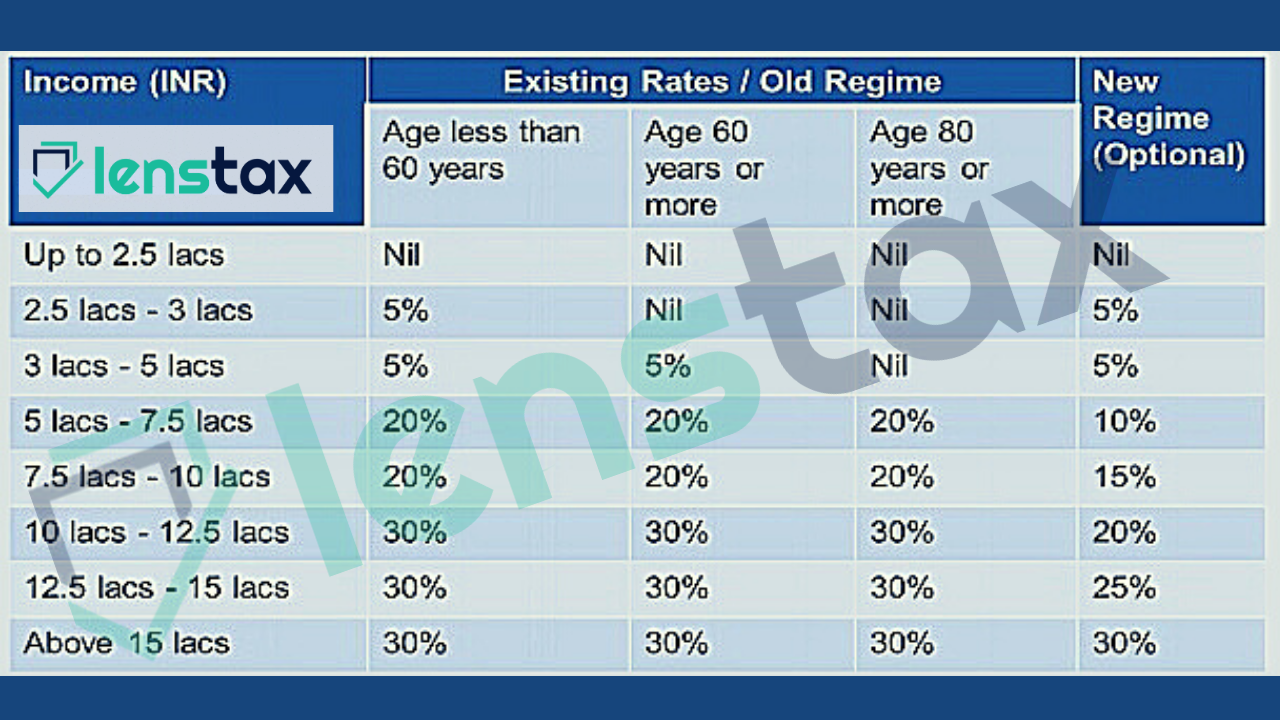

TAX RATES

For Individual and HUF

CONDITIONS TO BE FULFILLED TO AVAIL BENEFIT OF NEW REGIME

-

The following Exemption/Deduction needs to be forgone to avail benefit of new regime tax slabs:-

-

Clauses referred in section 10 as follows:

-

Clause (5) – Leave travel concession;

-

Clause (13A) – House rent allowance;

-

-

Clause (14) – Special allowance detailed in Rule 2BB (such as…

-

Children education allowance, hostel allowance, transport Allowance, per diem allowance, uniform allowance, etc.)

-

Clause (17) – Allowances to MPs/MLAs;

-

CONT .…..

- Standard deduction, deduction for entertainment allowance and employment / professional tax as contained in Section 16

- No set off loss under the head house property with any other head of income

- Interest under section 24 in respect of self-occupied or vacant property

- Loss under the head Income from House Property for rented house shall not be allowed to be set off under any other head and would be allowed to be c/f as per extant law

- Any section 80CCD deduction under chapter VI-A, However, deduction under sub-section (2) of (employer contribution on account of employee in notified pension scheme) and section 80JJAA (for new employment) can be claimed

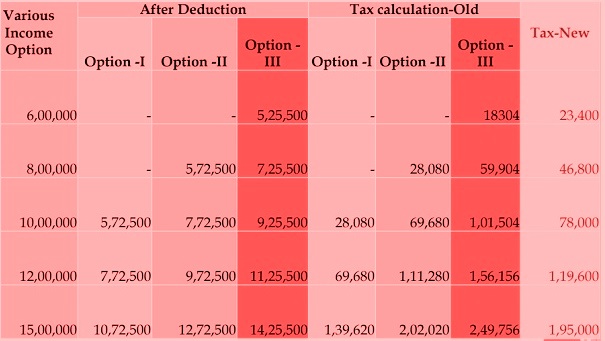

DEDUCTION AND EXEMPTION IN OLD REGIME

|

Deductions |

Option -I |

Option -II |

Option –III |

|

Standard Deduction |

50,000 |

50,000 |

50,000 |

|

PT |

2,500 |

2,500 |

2,500 |

|

80C |

1,50,000 |

1,50,000 |

– |

|

80D |

25,000 |

25,000 |

25,000 |

|

House loan Int |

2,00,000 |

– |

– |

|

4,27,500 |

2,27,500 |

74,500 |

COMPARE TAX UNDER EXISTING AND NEW REGIME

QUICK REFERENCER

- First you calculate your gross total income

- On the basis of gross total income plan your saving, investment for retirement and off course for tax saving.

- Invest your fund in long term as well as in short term

- Save your fund in Gov. securities, FDR, PPF, RD also

- Take mediclaim, Life Insurance for family

- Your senior citizen parents can also help to save tax eg. Take mediclaim, invest in the name of parents.

- In new option various deduction ,exemption are not available.

- Choose new option only if its beneficial to you

- Continue your saving, investment , if you choose new option

- Investment in RD is not getting benefit of Sec 80C