Statutory compliance in Indian payroll

Updated on : 2020-Nov-12 17:43:54 | Author :

Statutory compliance in Indian payroll

When you run payroll, being statutory compliant implies that you're paying as per the applicable employment norms set by the central and state legislation. The common statutory needs that apply to Indian businesses include the availability for minimum wages, payment of overtime wages to employees, TDS deduction, contribution to social security schemes like PF, ESI, etc.

While computing salary you need to include all these deductions and contributions. Income tax is one such deduction. At the start of the year, the worker is asked to form a declaration concerning his further incomes, tax-saving investments, etc. called ‘income tax declaration.’ Accordingly, the employee’s tax liability is calculated, and TDS is deducted.

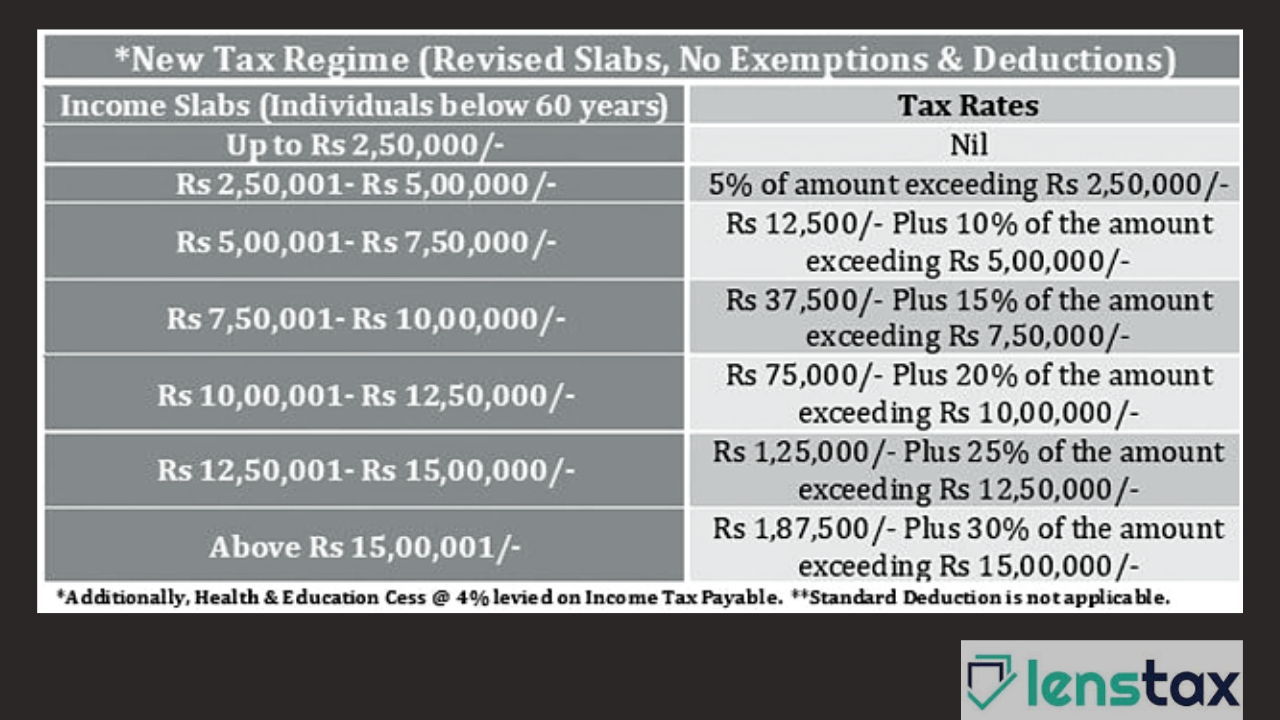

Let’s check how to calculate tax for any individual. In India, we have seven tax brackets with an increasing tax rate.

Tax slabs for FY 20-21

Based on above tax slabs, you'll calculate monthly liabilities and deduct TDS. The TDS is then deposited monthly with the govt., and a quarterly report of all deductions is additionally filed. Once you complete TDS returns for the fourth quarter, you'll issue form 16 to staff.

The employees utilize this form 16 as proof of tax deducted at the time of filing their individual income tax return.

Non-adherence with the law will lead to hefty fines and penalties. that is why you wish to be up to date on all tax and payroll statutory changes.

Challenges in handling payroll management process

The payroll process becomes challenging due to two vital reasons.

The requirement to stay statutory complaint

As mentioned before, non-adherence to statutory laws will cause levy of fines and penalties and in the worst case could even threaten the existence of the business. Nowadays there are some advanced payroll management software package that mechanically processes payroll in compliance with statutory laws.

Dependence on multiple payroll inputs sources

Before payroll will be processed, you wish to get all the info together from sources like attendance register, conveyance facility availed record, data from hr team like salary revision info, etc., creating it a sophisticated method. for several years hr and payroll officers were managing payroll on excel sheets, however excel sheets have issues like dependency on excel formulas for wage calculation, complexity in adding and removing employees and other limitations like manual data entry, problem in extracting info, etc.