Revolutionizing Finance: Exploring the Dynamics of the Digital Lending Market

Updated on : 2023-Oct-08 10:47:50 | Author : Barsita Sain

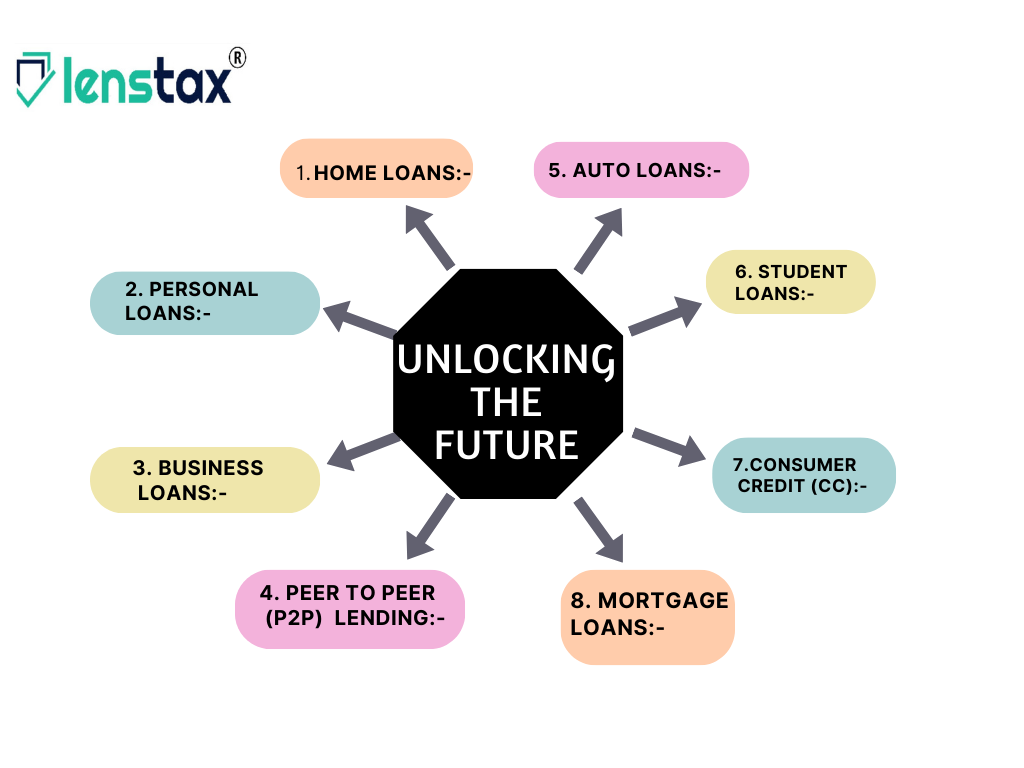

The digital lending market has seen significant growth and transformation in recent years, with various types of loans being offered online. This market encompasses a wide range of loan products, including but not limited to home loans, personal loans, and more. Let's take a closer look at these segments within the digital lending market:-

1.Home Loans:-

Overview:-

Home loans are one of the most significant segments within the digital lending market. These loans are used by individuals to purchase or refinance residential properties.

Online Mortgage Lenders:-

Many online mortgage lenders have emerged, offering streamlined application processes, quick approvals, and competitive interest rates.

Digital Documentation :-

Borrowers can submit their documents electronically, reducing the need for physical paperwork and making the process more convenient.

2.Personal Loans:-

Overview :-

Personal loans are unsecured loans that can be used for various purposes, such as debt consolidation, medical expenses, or travel.

Online Personal Loan Platforms:-

Numerous online platforms and fintech companies provide personal loans with easy application processes and rapid approval times.

Credit Scoring Algorithms:-

Many digital lenders use innovative credit scoring algorithms that consider alternative data sources beyond traditional credit scores, making loans accessible to a broader range of applicants.

3.Business Loans:-

Overview:-

Digital lending has also expanded into the business sector, offering loans to small and medium-sized enterprises (SMEs) for expansion, working capital, or equipment financing.

Online Business Loan Platforms:-

Fintech companies and online lenders offer business loans with simplified application procedures and quick access to funds.

Data-Driven Approvals:-

Business loans often rely on advanced data analytics and cash flow analysis to assess creditworthiness.

4.Peer-to-Peer (P2P) Lending:-

Overview:-

P2P lending platforms connect borrowers with individual lenders, eliminating the need for traditional financial institutions.

Diverse Loan Types:-

P2P lending encompasses various loan types, including personal loans, small business loans, and student loans.

Risk Assessment:-

These platforms typically use algorithms and credit risk assessment tools to match borrowers with suitable lenders.

5.Auto Loans:-

Overview:-

Digital lending has also extended to auto financing, with online platforms offering loans for the purchase of new or used vehicles.

Online Auto Loan Providers:-

Many digital lenders collaborate with car dealerships and online auto marketplaces to simplify the loan application and approval process.

Digital Tools:-

Borrowers can use online calculators to estimate loan payments and explore various financing options.

6.Student Loans:-

Overview:-

Digital lending platforms provide student loans to cover educational expenses, including tuition, books, and living costs.

Flexible Repayment Plans:-

Some platforms offer income-based repayment plans and refinancing options to help borrowers manage their student loan debt more effectively.

7.Consumer Credit (CC):-

Overview:-

Digital lending includes consumer credit products, such as credit cards and lines of credit, which can be applied for and managed online.

Digital Wallets:-

Some fintech companies offer digital wallets with integrated credit lines for convenient spending.

8. Mortgage Loans:-

A Mortgage loan is a financial arrangement in which a borrower obtains funds from a lender to purchase real estate, typically a home. This loan is secured by the property itself, meaning that if the borrower fails to repay the loan according to the agreed-upon conditions, the lender has the right to take occupancy of the property through a legal process known as foreclosure.

Mortgage loans are a common way for individuals and families to purchase homes, as they provide access to financing over an extended period, making homeownership more attainable. However, it's essential for borrowers to understand the terms of their mortgage and their financial responsibilities to avoid potential financial difficulties.

In Conclusion, The digital lending market continues to evolve, driven by advancements in technology, data analytics, and changing consumer preferences. It offers borrowers greater convenience, quicker access to funds, and, in some cases, more competitive terms. However, it's essential for borrowers to exercise caution, understand the terms and conditions, and assess the credibility of the online lenders they choose to work with.