Nidhi Company Registration in Katwa

Updated on : 2022-Sep-14 17:04:31 | Author : Avijit Ghosh

Katwa is a small town beside the Ganga River. Katwa is situated in the east part of Purba Bardhaman and bounded by water to the east, west and north by the Ganga River. Here the Ajay river and Ganga (Hooghly) river are joined. The place was famous for the Shree Chaitanya Mahaprabhu, khepakali mandir, Ganga river and the very old mosque present in bagane para. Katwa police station has jurisdiction over the Katwa and Dainhat municipalities, and Katwa I and Katwa II CD Blocks. the total population near about 87 thousand, the entire population divided into two parts, firstly 88.44 per cent people are live in a rural area and secondly the rest 11.56 per cent people are live in an urban area. So a large number of people engaged in farming and fishing.

The small town has a historical background of five hundred years. The Katwa has previously known as Indranee Pargana. Later the name was changed to Kantak Nagari. Sri Chaitanya Mahaprabhu received "Diksha" from his guru Kesava Bharati at the current Sri Gauranga Bari Temple In January 1510. Since then, this small township has been a holy place for Vaishnavites.

Katwa was considered the gateway to Murshidabad, the erstwhile capital of Nawab Murshid Quli Khan. Under the aegis of the British East India Company. Present Katwa town was established in 1850 when it was granted the status of a subdivisional town under the 10th Act of Municipal Rules. The Municipality of Katwa as a governing entity was established on 1 April 1869. The urbanization of Katwa received a further boost with the construction of railroads in the early 20th century: Katwa-Azimganj, Katwa-Bandel, Katwa-Bardhaman, Katwa-Ahmedpur.

Nidhi Company Registration in Katwa

This type (class) of the companies come under the Companies Act, 2013 and is regulable as per the Reserve Bank’s guidelines. All the transactions in Nidhi Company occur in between the members only. These companies enjoy relaxations in several exemptions from the core provisions of the Reserve Bank. This is one of the interesting factors that separate the Nidhi companies from other Non-Banking Financial Companies. Ministry of Corporate Affairs (MCA) has laid down the foundation of Nidhi Companies. MCA does not regulate every prospect of these companies. Instead, they only intervene in the matter of relating to their deposit acceptance activities.

Nidhi means a business entity that has been incorporated with an object to develop the habit of saving and procure funds amongst the members for their mutual benefits. These companies are also recognized as Benefits funds, Mutual benefit, permanent fund, and Mutual benefits fund companies.

WHY CHOSE LENSTAX FOR NIDHI COMPANY REGISTRATION

- Free Tax Consultant

- GST Number

- Return Filing with Nominal fees

- 24x7 Support

- Exprienced Resoures

- Dedicated Account Manager

WHY CHOOSE LENSTAX?

- Quick Service @ Lowest Price Guaranteed

- Complete Online, No Hidden Cost

- More than 30 legal specialists and Chartered Accountants are there for your support.

- 2 Days Quick Process

- Get the best recommendation.

- Call us anytime and get support for your business.

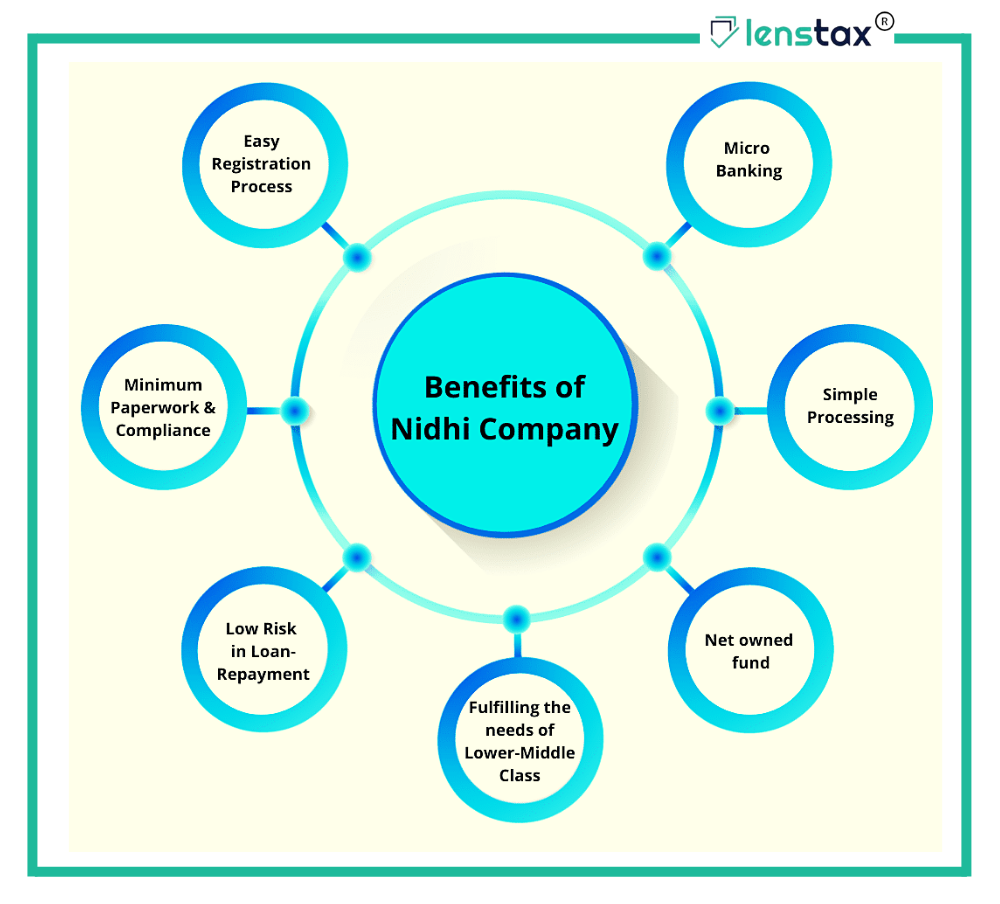

Benefits of Nidhi Company in India

Easy Registration Process

If you wish to enter the NBFC sector with less investment, then Nidhi Company is the best option for you. A Nidhi Company requires a paid-up equity share capital of 5 lakhs to begin with, whereas an NBFC requires a net worth of Rs 2 crores. Other than low investment, the overall process of Nidhi Company Registration is free from all complexities, and one doesn’t need to attain a license from RBI to incorporate a Nidhi company. Moreover, the documentation process is also quite less, and the registration process gets completed within one or two weeks.

Minimum Paperwork and Compliance

Nidhi Company, by its nature of functioning, falls under the category of NBFC but does not require approval from RBI. Nidhi Companies are governed under the Nidhi Rules, 2014, and have to follow fewer guidelines imposed by RBI. RBI has exempted Nidhi companies from its stringent compliances, which make it easier to run a Nidhi Company in India.

Low Risk in Lon-Repayment

According to Nidhi rules, 2014, a Nidhi Company can accept deposits and provide loans to its members only. This way, the risk of non-repayment of loans is minimized. Since Nidhi Companies are both owned as well as managed by their members only, it reduces the intervention from outsiders and hence reduces the risk of non-repayment of loans.

Fulfilling the needs of Lower-Middle Class

Nidhi Companies play a very important role in meeting the demands of lower and middle-income society by extending financial support to them without any further involvement of documentation. Additionally, these Companies help their members to channelize their small savings and earn attractive interest on them.

Net owned fund

Net owned fund implies the amount of capital that has been spent by the owner in his business to raise funds.

Net Owned Funds = aggregate of paid-up equity share capital+ free reserves - accumulated losses and intangible assets appearing in the last audited balance sheet.

In the case of Nidhi Companies, the ratio of Net Owned Fund is 1:20, which means on investment of 1 rupee, one shall raise a deposit of twenty rupees.

Simple Processing

Since Nidhi Companies extends the benefits of deposit and loans to its members only, this makes the entire process of availing loans comparatively less complicated than dealing with the Banks.

Micro Banking

Among other benefits of Nidhi Company comes Micro- Banking that it offers. Nidhi Companies offers banking services to the rural and remote public of India, those who are let out of the traditional banking system. Areas situated in far-off locations receive micro banking services through Nidhi companies.

Pre-Requisites of Nidhi Company Registration

Following are the pre-requisites of Nidhi Company Registration in India:

- Minimum number of Directors required: 3

- Minimum number of members required: 7

- Minimum Capital requirement for incorporation of a Nidhi company: Rs 5 lakh

- The words Nidhi Limited shall be suffixed in the name of a Nidhi Company.

- The main objective of Nidhi Company should be to foster the habit of saving among its members by receiving deposits and lending money to them when in need.

Fecality’s of Nidhi Company

Simple Formation of Nidhi Company

- The formation of the Nidhi Company is very easy process.

- It requires only 7 members out of which 3 members would be the directors.

- Nidhi Company does not require to obtain a licence from RBI.

- The Nidhi company takes hardly 10-5 days to get registered.

- Also no. of the documents required for the registration are very less.

Capital required for registration

- The capital requirement for the registration of Nidhi company is very less compared to other types of finance company.

- The minimum capital requirement for the registration of Nidhi company is 5,00,000 Rs. only

- Where there lies an opportunity to invest the capital within two months after the registration also by paying the registration fees of Rs. 19,999 Rs.

Limited RBI Regulations

- Nidhi Company though it is a finance company and falls under the category of NBFC, does not require approval of RBI.

- Nidhi Companies are exempted from main provisions otherwise applicable to an NBFC in India.

- These companies follow Nidhi rules 2014 issued by the center in respect of the activity and working of the company.

- There would be least intervention of RBI

No outsider intervention

- The Nidhi Companies are formed, managed and provides benefits only to their members.

- The outsider will not be allowed to intervene in Nidhi on any ways. Be it working of the Nidhi companies or depositing money with them or even avail credit from Nidhi.

- There would be no external intervention in the management as well.

Benefits to the members

- Nidhi Company works with the objective of increasing savings of its members.

- It is very easy to make donations and get loans from the company for its members

- The loans given to the members at a lower rate compared to the market rate hence it attracts the members to do more savings.

- The net owned fund ratio of Nidhi Company is 1:20. That means you invest 1 rupee and you will get a deposit of 20 rupees

- The investments in the Nidhi Company are secured ones. The risk of non payment of loans is less as compared to other finance businesses.

Exemptions and privileges under the Companies Act,2013

- Accordingly certain provisions of the Companies Act,2013 shall not apply to the Nidhi Company and Nidhi would be exempted from certain provisions of the same.

- Service of documents to Nidhi members may be done by sending it to him by post or by registered post or by speed post or by courier or by delivering the same at his office or by such electronic or other mode as may be prescribed.

- A Nidhi Company is free to make a private placement to any number of persons and it shall not be deemed to be an offer to the public.

Nidhi Company offers a lot of advantages to its members, however it is not aloof from certain drawbacks also which are mentioned below.

Limited Fund Raising

- The Nidhi company accepts deposits of the members only hence the funds of the Nidhi company are very limited as compared to other finance companies.

Limited credit availability

- As the funds raised are limited the availability of the credit will also be limited as compared to the other finance companies.

RBI vigilance

- Though the Nidhi Companies are free from the strict compliance of the RBI regulations, their deposit acceptance operations are governed by the RIB

Other Regulations

- The central government issues rules and directions governing Nidhi Companies from time to time. Therefore, they are not totally exempt from the regulatory framework.

The financial Markets are very vast in India and the financial needs are also increasing day by day. And here the Nidhi Company sets a new trend in the financial Market. Its benefits are such that a lot of people from all over India are attracted to the idea and now are registering the Nidhi company.

Report on Nidhi Companies in katwa, MCA, Nidhi Company Registration at katwa, Online Process, Nidhi Company Meaning, Key Features, advantages, Nidhi Company Registration Online in katwa, Nidhi Company Registration Procedure in katwa, Documents, Nidhi Company registration in katwa, eNidhi finances and rules in katwa, Nidhi Company Registration in India, what is nidhi company in katwa, process of registration nidhi company in katwa, advantages of nidhi company registration in katwa, documents required for nidhi company registration in katwa, nidhi company rbi guideline in katwa, process of nidhi company registration in katwa, process of nidhi company registration in katwa, regulators of nidhi company in katwa, nidhi company utilize fund procedure in katwa, nidhi company registration under the 2013 company act in katwa, condition for a nidh company opening branch in katwa, nidhi company registration fees, nidi company regiatration, Nidhi company registration Registration, Nidhi Company Registration application, Nidhi Company Registration consulant in katwa, Nidhi Company Registration office in katwa, Nidhi Company Registration registration procedure, Nidhi Company Registration consulant, Nidhi Company Registration expert, lenstax, nidhi company registration Registration, nidhi company registration Registration Consultant, near me, Best nidhi company registration at low cost near me, NIDHI COMPANY REGISTRATION, Comany Tax Consultant in katwa, nidhi company registration Practice Firm in katwa, nidhi company registration registration expert, nidhi company registration Consultant, Nidhi Company Registration registration, Nidhi Company Registration registration at , Nidhi Company Registration registration at ,Nidhi Company Registration registration at , Nidhi Company Registration registration in katwa