LEADING PERSONAL LOAN LENDING COMPANIES...

Updated on : 2023-Sep-12 13:23:38 | Author : Barsita Sain

Personal loans are a popular financial product that provides individuals with the flexibility to borrow money for various purposes, such as debt consolidation, home improvements, medical expenses, or even a dream vacation. There are numerous lending companies in the market, each offering different terms, interest rates, and eligibility criteria. Here, we will highlight some of the leading personal loan lending companies as of my last knowledge update in september 2021.

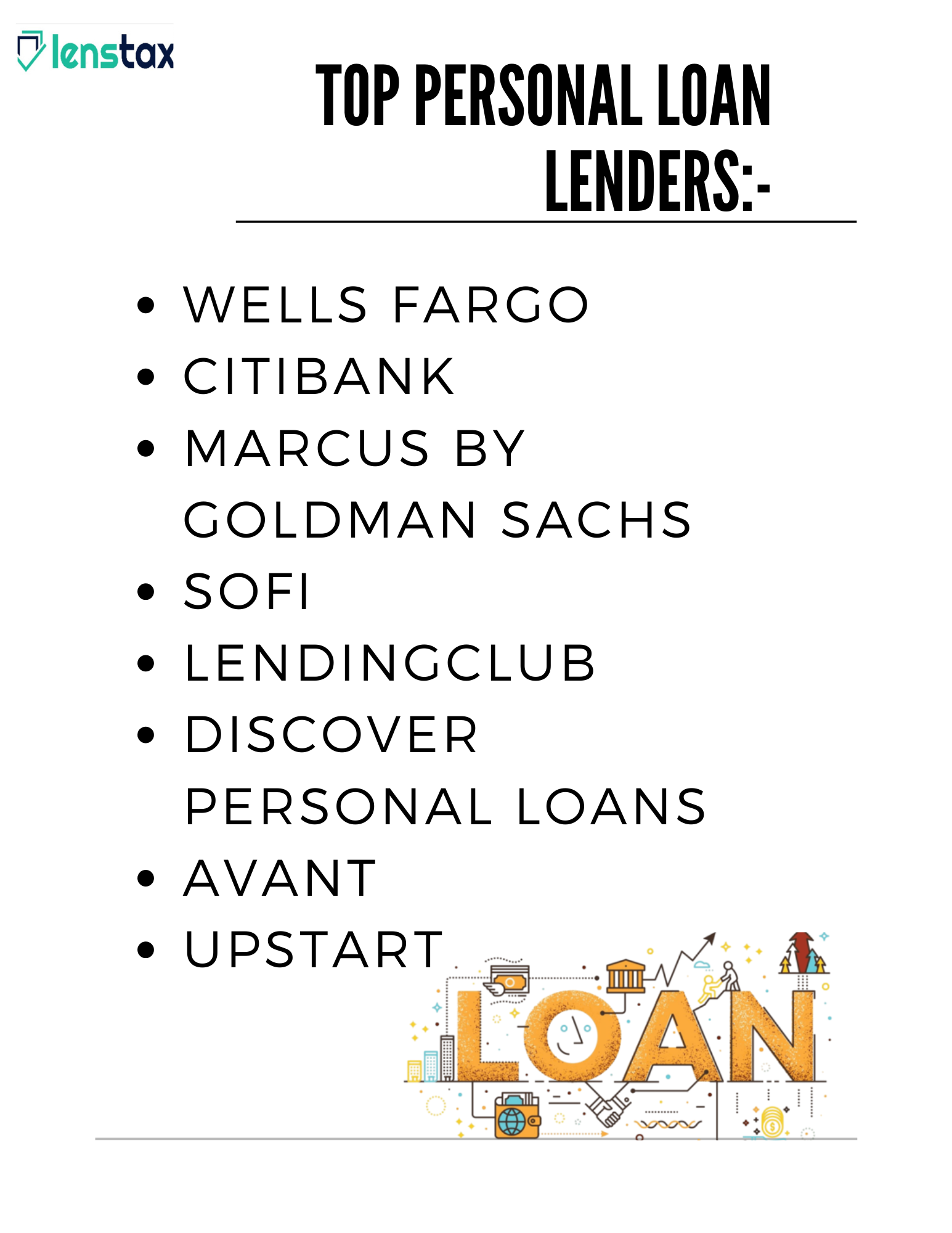

Explore the Top Personal Loan lenders for your financial needs:-

1. Wells Fargo:-

Wells Fargo is a well-established bank in the United States and offers personal loans with competitive interest rates. They provide both secured and unsecured personal loans, making them accessible to a wide range of borrowers.

2. Citibank:-

Citibank is a global banking giant that provides personal loans to accomplished applicants. They offer flexible terms and vying interest rates for borrowers with good credit.

3.Marcus by Goldman Sachs:-

Marcus is an online debt platform by Goldman Sachs that specializes in personal loans. They are known for their straight forward and colorless lending process, with no fees or hidden charges.

4.SoFi:-

SoFi obtained notability for its innovative approach to personal lending. It stood out with its member-focused approach and emphasis on providing financial education alongside loan products.

5.LendingClub:-

As one of the pioneers in the peer-to-peer lending model LendingClub maintained its position as a major player in the personal loan industry. It connected borrowers with investors looking to fund loans, thereby potentially offering more favorable rates to borrowers compared to traditional financial institutions.

6.Discover Personal Loans:-

Discover is a well-known credit card issuer that also provides personal loans to qualified borrowers. They offer competitive interest rates and a user-friendly online application process.

7.Avant:-

Avant specializes in providing personal loans to borrowers with less-than-perfect credit. They have a fast approval process and may be a suitable option for those with credit challenges.

8.Upstart:-

Upstart distinguished itself by utilizing artificial intelligence and machine learning in its underwriting process. This innovative approach allowed Upstart to assess borrowers' creditworthiness beyond traditional credit scores, considering factors such as education and job history.

In Conclusion, the financial industry is continually evolving, it's essential to verify the latest information and offerings from these and other personal loan lenders before making any decisions. Furthermore, your eligibility for a personal loan and the terms you qualify for may depend on your credit score, income, and other financial factors, so be prepared to provide this information during the application process.