How is TDS deducted?

Updated on : 2020-Nov-20 13:32:07 | Author :

TDS Deduction

In case an individual has paid a surplus amount as compared to the liable tax amount, the recipient will file a claim for a refund of the surplus amount. Also, TDS deductions are calculated on the basis of many factors for people from different types of income categories.

How is TDS deducted?

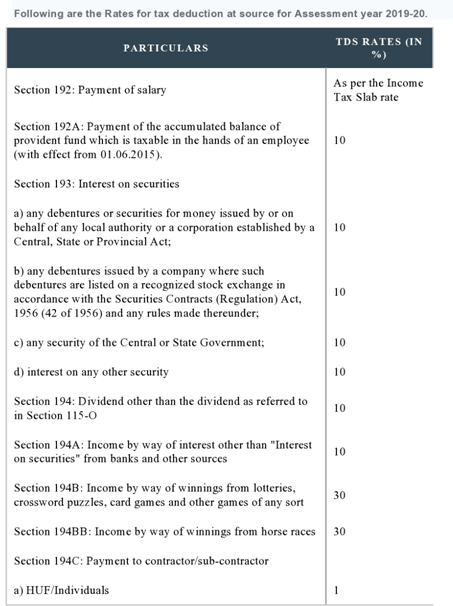

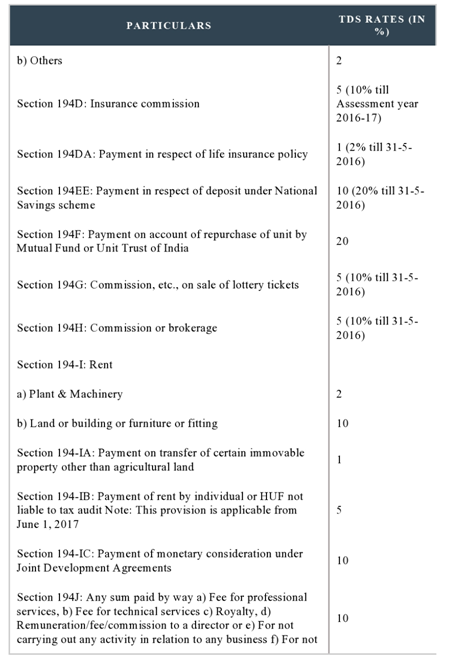

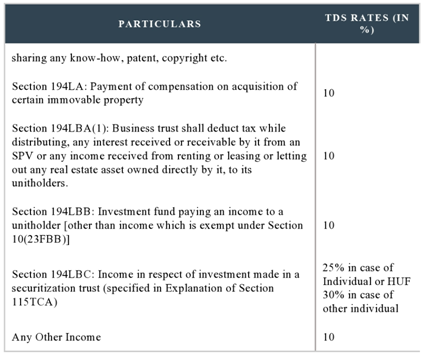

Both of the income and expenditure as the salary, lotteries, interests from banks, rent payment, payment of commissions, and payments to freelancers etc. fall under the range of TDS. Therefore, once a payment is created under these segments, a share of the payment is withheld by the source that is making the payments. These sources are often a person or a company, referred to as the ‘Deductor’. And therefore the person whose payment is getting deducted is termed the Deductee.

For example: Amit works for a company named KBL Corporation. During this case, KBL Corporation may be a deductor who is paying salary to the worker who is that the deductee.

Note: Under the laws stated by the govt, any kind of payment made from one party to another are going to be subject to TDS while complying with the provisions of the income tax Act, 1961. Here, the tax are going to be deducted at source and can be deposited to the Department of income tax.

Incomes on which TDS is not collected

There are some incomes on which TDS is not collected, at source, they are as following:

- Interest which is paid to the central or the state financial organizations.

- Institutions which are notified under no-TDS.

- Interest earned on KVP, NSC or Indira Vikas Patra schemes.

- Interest earned on NRE accounts.

- Interest earned from Recurring Deposits or Savings Account opened in co-operative societies.

- Interest earned from Recurring Deposits or Savings Account opened in co-operative societies.

- UTI, LIC and other insurance or co-operative societies.

Note: The list of institutions which are not subject to TDS are available on the official Income Tax website.

TDS Return

It is essential to file a TDS return to keep up a healthy financial record and one will file it by visiting the tax web site i.e. www.incometaxindia.gov.in

One must sign up to the web site by using credential certification or by registering for the services. Since there are specific deadlines, it's vital that an individual ensures that the TDS is filled with in due time.

Also, an individual must ensure that forms are filled as per his/her financial gain category. Further, they need to supply needed documents to process the refund. And post submitting the return, he/she can have to be compelled to validate the TDS return file. This validation will be done by using the free software package provided by the tax Department.

However, just in case you're searching for the refund of access for the TDS paid, then you may have to be compelled to file through TDS return to receive a refund for the surplus amount.