HOW IS L & T FINANCE PROGRESSING IN THE MARKET, AND HOW IS THE GENERAL PUBLIC TRUSTING IT? ARE LOANS AVAILABLE WITH PAN CARD AND AADHAAR CARD? LETS CHECK....

Updated on : 2023-Sep-15 11:38:56 | Author : Sumi Biswas

DIVERSE FINANCIAl SERVICES:

L&T Finance Holdings Limited has established itself as a one-stop destination for a wide spectrum of financial services. Whether you are an individual looking for personal loans, a business owner seeking working capital finance or an investor planning to grow your wealth, L&T Finance has you covered and a reliable choice for all your financial requirements.

LOAN SERVICES OF THE COMPANY ARE MENTIONED BELOW:

Retail Loans: L&T Finance provides personal loans, home loans, and vehicle loans tailored to suit individual needs. Their customer-centric approach ensures that you get the best deals with competitive interest rates.

Business Loans: For entrepreneurs and business owners, L&T Finance offers a range of financing options to support business growth. Whether you need funds for expansion, working capital, or equipment purchase, their business loan offerings are designed to facilitate your success.

Investment Solutions: L&T Finance also provides investment and wealth management services to help you achieve your financial goals. Their team of experts can guide you through various investment options, helping you make informed decisions.

Microloans: L&T Finance extends financial support to this sector, enabling them to thrive and contribute to the economy.Recognizing the importance of micro, small, and medium-sized enterprises .

TECHNOLOGY SOLUTIONS:

In today's technology plays a vital role in the financial industry. L&T Finance Holdings Limited understands this and has made significant investments in technology to enhance their services. Here's how they stay ahead of the curve.

Online Loan Application: L&T Finance offers the convenience of applying for loans online. Their user-friendly digital platforms ensure a hassle-free application process, reducing paperwork and processing time.

Robust Mobile Apps: With mobile apps designed for both Android and IOS devices, customers can access their accounts, check balances, make payments, and apply for loans on the go.

Secure Transactions: L&T Finance prioritizes the security of your financial transactions. They employ state-of-the-art encryption and security measures to protect your sensitive information.

Customer Support: In addition to technology, they maintain excellent customer service to assist customers at every step of their financial journey. Whether you have a query or need assistance, their dedicated customer support team is always ready to help.

LOAN PRODUCTS TAILORED TO YOUR NEEDS:

One of the well features of L&T Finance Holdings Limited is its wide range of loan products designed to cater to diverse needs:

Personal Loans: Need funds for a medical emergency, wedding, or vacation? L&T Finance offers 5personal loans with flexible repayment options.

Home Loans: Realize your dreamof owning a home with L&T Finance's home loan offerings, which come with competitive interest rates and attractive features.

Vehicle Loans: L&T Finance provides vehicle loans with quick approval and easy repayment terms. Whether you're eyeing a new car or a two-wheeler.

Business Loans: Business owners can access working capital, term loans, and customized financial solutions to fuel their growth ambitions.

In conclusion, L&T Finance Holdings Limited is a trusted financial company that stands at the intersection of financial, technology, and customer-centric services. With a wide range of financial offerings and innovative technology solutions. Whether you are an individual looking for a loan, a business looking for growth capital, or an investor planning for the future, L&T Finance has the solutions to help you achieve your financial goals.

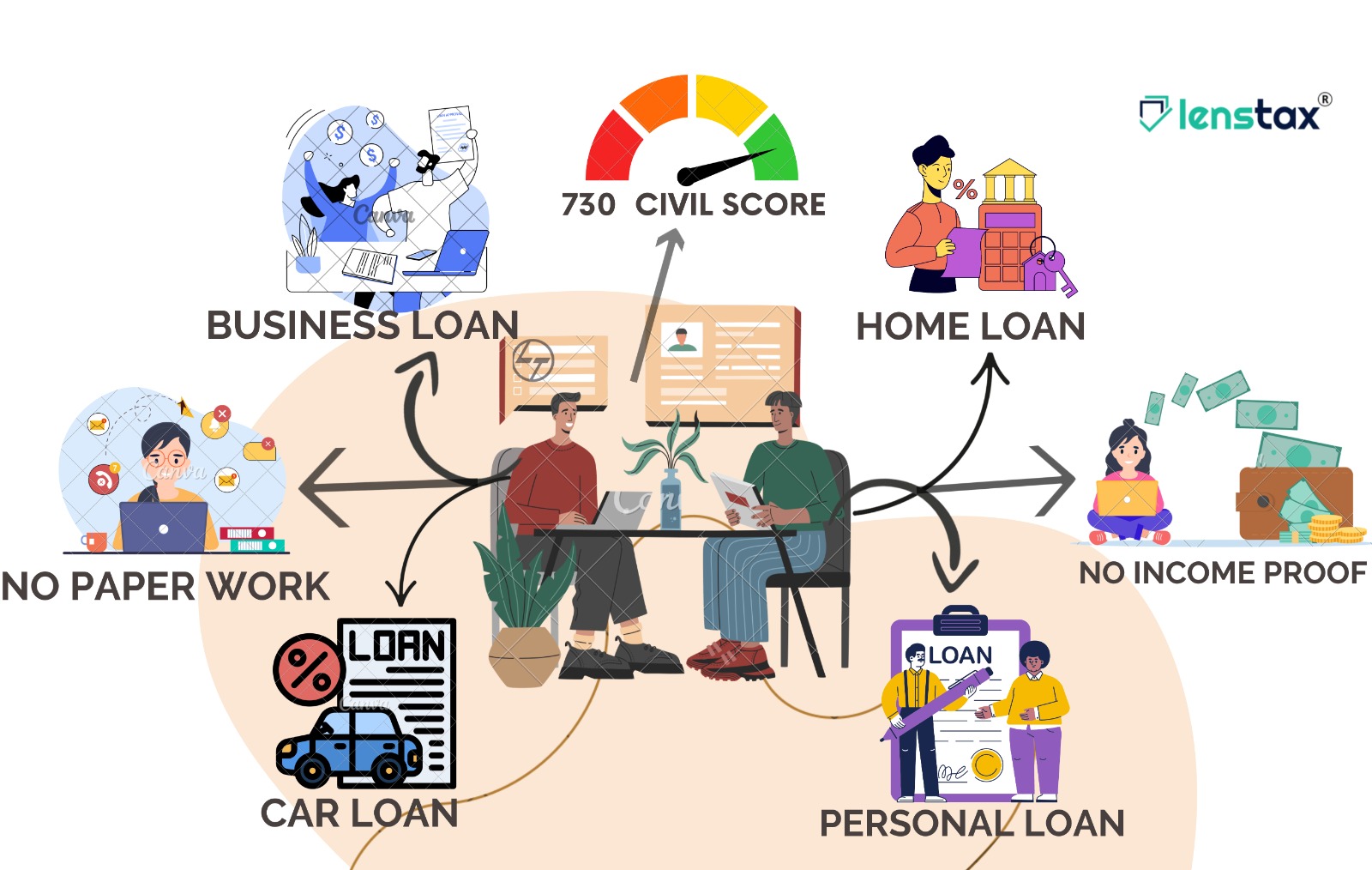

KEY TO THE L&T FINANCE CONSUMER LOAN:

• Loan Amount: 50,000/- to 7,00,000/-

• Loan term: 12 to 48 months

• Paper: No paperwork

• Who gets the loans: Salaried and self-employed professionals, both

• Income proof: No need

• Residential Status: Indian Citizens with a valid ID proof

• Age: 23 to 57 years

• Credit scores: 730 plus

Understanding customer sentiment and trust is an ongoing process for L&T Finance. Regular feedback loops, market research, and assessments of customer satisfaction help the company gauge its performance in these critical areas. By consistently prioritizing transparency, ethical practices, customer-centricity, and data security, L&T Finance aims to nurture and strengthen the trust that its customers place in its financial expertise.