Extension of time limits of certain compliance to provide relief to the taxpayers

Updated on : 2021-May-30 20:47:23 | Author :

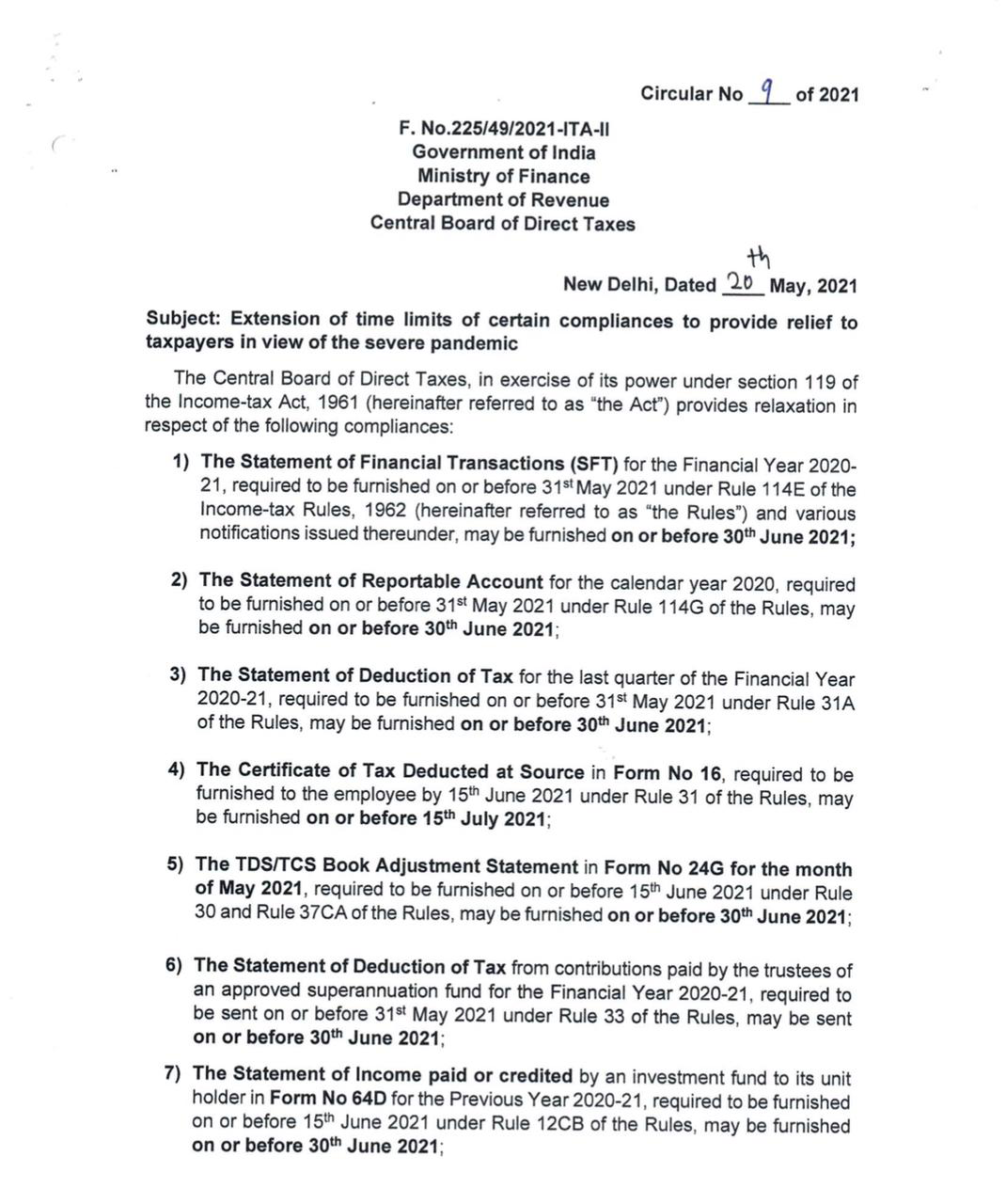

In the present time, India deals with a very critical situation to fight against coronavirus. WHO has already declared that the spread of COVID-19 is a pandemic since March 2020. The first wave of the covid-19 hit in march of 2020 after some months the second wave of covid-19 hit, which causes India to face a very problematic situation. India the second largest populous country, so covid-19 second wave spread a very larger way. The central board of direct taxes decided to provides the relaxation for FINANCIAL YEAR 20-21 INCOME-TAX COMPLIANCES in the exercise of its power under section 119 of the income tax act, 1961.

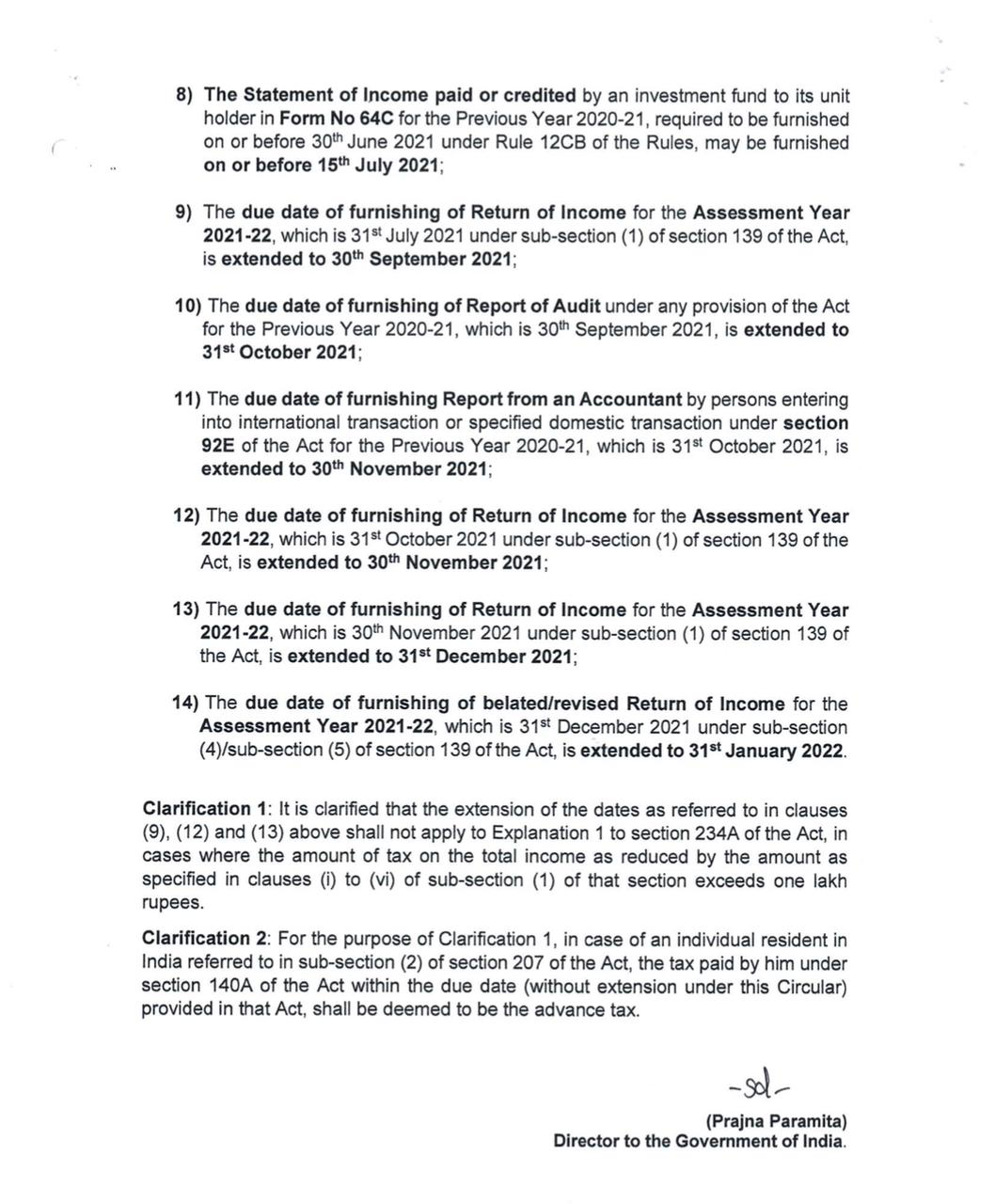

The central board of direct taxes decided to Extention the date for FINANCIAL YEAR 20-21 INCOME-TAX COMPLIANCES, the statement of financial transaction (SFT) furnished before the 30th June 2021 instead of 31st May 2021, the statement of reporting account furnished before of 30th June instead of 31st May, the statement of deduction of tax extended up to 30th June instead of 31th may, Furnishing of Return of income tax for the assessment year 2021-2022 extended up to 30th September 2021 instead of 31Th July 2021. Furnishing of Report of Audit previous year 20-21 31st October 2021 instead of 30th September 2021. More important date related to income-tax compliances showing in the table below.