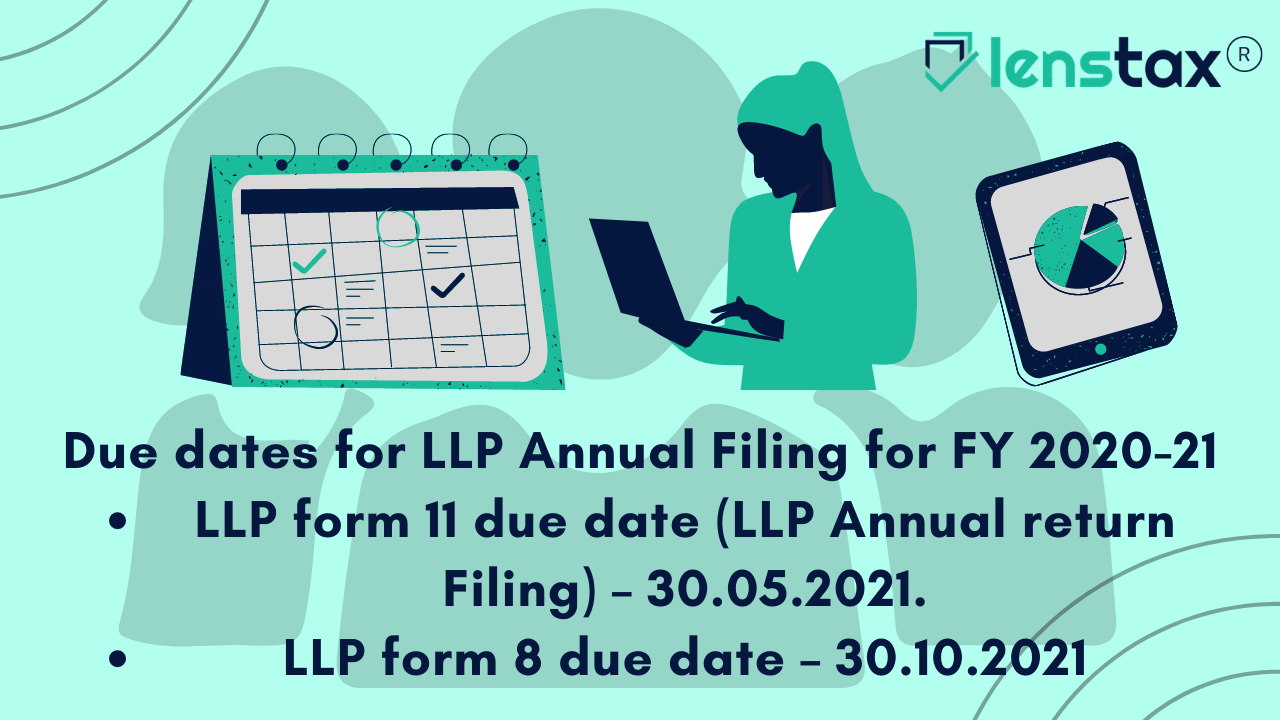

Due dates for LLP Annual Filing(LLP form 8 due date– 30.10.2021 & LLP form 11 due date– 30.05.2021)

Updated on : 2021-May-31 13:29:44 | Author :

A business structure that wants a minimum number of 2 members and there's no limit on the maximum number of members is called a limited liability partnership. The liability of the members of the limited liability Partnership is limited. Here we discuss regarding the Compliance demand of an LLP, it's less than a private Ltd. Here we've created a calendar for all the important Statutory Due dates for LLP Annual Filing (LLP form 8 & LLP form 11) for FY 2020-21.

Important Statutory due dates for LLP

LLP Annual Filing

Every limited liability partnerships (LLPs) is important to file their annual return in form LLP 11 among 60 days from the end of the financial year and Statement of Account & sufficiency in form LLP 8 within 30 days from the end of six months of the close of the financial year.

It is necessary to do for every LLP to follow the statutory requirement like Annual return, income tax return, Profit and Loss Account, balance sheet, every year, even though it doesn't do any business. just like companies, LLPs are required to take care of their year, from 1st April to 31st March.

LLP form 11 due date (LLP Annual return Filing) – 30.05.2021

Every LLP registered in India is necessary to file its annual return in LLP form 11 within 60 days from the last date of the financial year which means the due date for filing LLP form 11 (LLP Annual return Filing) for the Financial Year 2020-21 is 30th May 2021.

- It is necessary for every LLP to file its Annual Returns and monetary statements with the Ministry of corporate affairs even if they are not doing any business.

- LLP Annual Return / LLP form 11 could be a summary of all the designated partners like whether there are any changes within the management of LLP or not.

- It is a compulsory requirement of law and even nil returns should be filed.

LLP form 8 due date – 30.10.2021

An annual filing form namely LLP form 8 could be a statement of Accounts and financial condition that has to be filed with roc every year.

Statement of Account and financial condition shall be filed with the roc within 30 days from the end of six months of the financial year to which the statement relates which means the last date for filing LLP form 8 (LLP Annual Filing) for the Financial Year 2020-21 is 30th October 2021.

This Form contains details like a declaration on the state of solvency or a detailed monetary statement of the LLP by the designated partners and additional information related to the statement of assets and liabilities and statement of the income and expenditure of the LLP.

The due date for IT Returns for LLP

This is not compliance exclusive to LLPs, however any business and people, although all LLPs should also file income tax returns on or before the due date.

For the Financial Year 2020-21, the last date for filing income tax Returns for LLPs that doesn't need a Tax Audit is 31st July 2021 and if Tax Audit is needed. The due date for IT Returns for LLP is 30th September 2021.

Even if the LLP has not done any business for the present financial year, they're needed to file a nil income tax Returns with the income tax authorities.

The Late fees (penalty) for form LLP 8 and LLP 11 filing

If an LLP doesn't file its annual filing forms within the given time, then there would be penalty of Rs. 100 per day per form is payable from the due date of filing return until the date actual return is filed.

It is one of the most important responsibilities of the designated Partners of an LLP to maintain a proper book of accounts and file an Annual return with the MCA every financial year. thence it's advisable that you mandatory file your form LLP 8 and form 11 before the due dates.