All About Invoice Furnishing Facility (IFF)

Updated on : 2021-Jan-04 12:22:10 | Author :

Invoice Furnishing Facility (IFF) permits tiny taxpayers to transfer their invoices each month. The Central Board of Indirect Taxes & Customs (CBIC) had notified the Invoice Furnishing Facility on ten.11.2020 via notification number 82 /2020-Central Tax.

1. What is the Invoice Furnishing Facility?

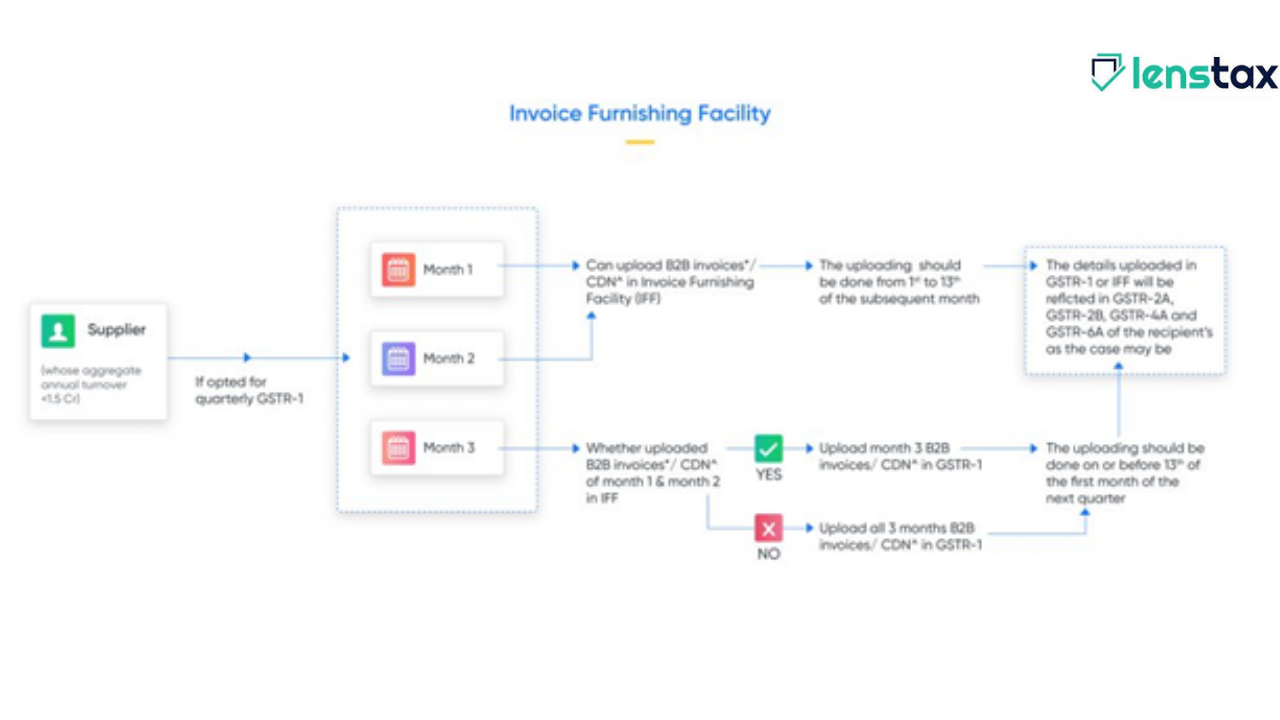

The Invoice Furnishing Facility (IFF) could be a facility where quarterly GSTR-1 filers will choose to upload their invoices every month. A quarterly GSTR-1 filer is a small taxpayer with a turnover of up to Rs.1.5 crore. One should keep the subsequent points in mind before utilizing the IFF:

• The IFF can be utilized only for the first 2 months of a quarter.

• The invoices relating to the last month of a quarter are to be uploaded in the GSTR-1 come only.

• There is no requirement to upload invoices in GSTR-1 if the same has been uploaded within the IFF.

• the total value of invoices that may be uploaded is restricted to Rs.50 lakh per month.

• The details submitted in IFF will be mirrored within the GSTR-2A, GSTR-2B, GSTR-4A, or GSTR-6A of the recipients as the case may be.

• The Invoice Furnishing Facility will come into result from 01.01.2021.

2. Who can use the Invoice Furnishing Facility?

Small taxpayers who file their GSTR-1 returns quarterly can utilize the Invoice Furnishing Facility. it is vital to note that if a taxpayer does not favor to upload invoice details through the IFF, he/she has to transfer all the invoice details for the 3 months of the quarter in the GSTR-1 return.

3. What is the purpose of the Invoice Furnishing Facility?

The taxpayers whose aggregate turnover is less than Rs.1.5 crore within the preceding financial year will file their GSTR-1 every quarter. This is allowed to reduce the compliance burden on tiny taxpayers. However, this creates problems for taxpayers who build purchases from little taxpayers in claiming Input tax credit (ITC).

For example, when a buyer purchases goods from a small taxpayer during a quarter, the buyer has to wait till the end of the quarter to claim ITC. the reason for the same is that a tiny low taxpayer can upload the invoices and complete the GSTR-1 filing only after the quarter is completed. This process caused a delay in claiming ITC as the buyer can claim full ITC only when the invoice seems in his/her GSTR-2A/2B.

Hence, the IFF has been introduced to remove these hardships and help the buyers from small taxpayers in claiming ITC.

4. What details are to be submitted in the Invoice Furnishing Facility?

The following details are to be submitted by the tiny taxpayers if they opt for Invoice Furnishing Facility:

• B2B invoice details of sale transactions (both inter-state and intra-state).

• Debit and credit notes of the B2B invoices issued during the month.

5. How to use the Invoice Furnishing Facility?

As the Invoice Furnishing Facility is optional for the quarterly GSTR-1 filers, the GST portal may provide a timeline to opt-in for the same. Once the small taxpayers opt for it, the GST portal can offer this facility to those quarterly filers for the first two months of the quarter. The invoices should be uploaded in IFF from the first to the 13th of the subsequent month.

As of now, the format of IFF has not yet been notified, and we will expect a notification for the format and manner of uploading the invoice data soon. There has also been no clarity yet on whether an offline tool is provided or not.

6. Advantages of using the Invoice Furnishing Facility

The following are the benefits of Invoice Furnishing Facility:

• Buyers of goods from small taxpayers can claim ITC monthly.

• It allows the monthly reconciliation of data and makes return filing easier.

• Small taxpayers will increase their business by providing faster ITC claims.

• Eases the compliance burden by reducing the volume of invoices to be uploaded at the end of the quarter.

This is a good move to help both small taxpayers and buyers from little taxpayers. This facility can indirectly help tiny taxpayers to enhance their business by providing quicker ITC claims to their buyers. However, this may increase compliance costs for them. Hence, one has to build a comparison between the benefit of opting for IFF and the value concerned. it's smart to opt-in for this facility if a small remunerator raises large volumes of B2B invoices when compared to B2C invoices in a quarter.